浙大 国际金融学第10章的答案

- 格式:doc

- 大小:33.50 KB

- 文档页数:3

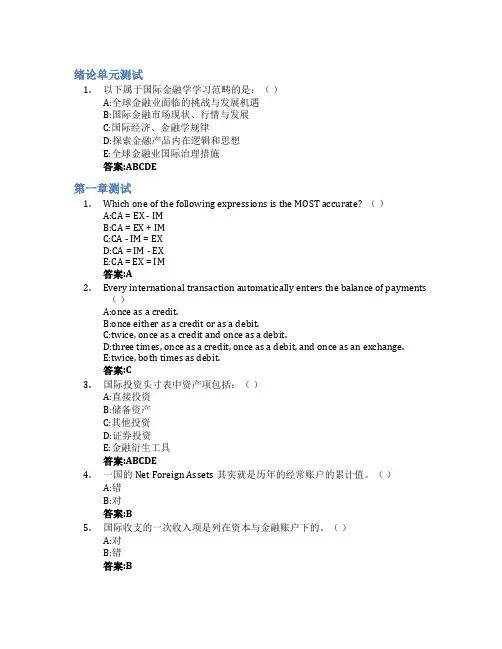

绪论单元测试1.以下属于国际金融学学习范畴的是:()A:全球金融业面临的挑战与发展机遇B:国际金融市场现状、行情与发展C:国际经济、金融学规律D:探索金融产品内在逻辑和思想E:全球金融业国际治理措施答案:ABCDE第一章测试1.Which one of the following expressions is the MOST accurate? ()A:CA = EX - IMB:CA = EX + IMC:CA - IM = EXD:CA = IM - EXE:CA = EX = IM答案:A2.Every international transaction automatically enters the balance of payments()A:once as a credit.B:once either as a credit or as a debit.C:twice, once as a credit and once as a debit.D:three times, once as a credit, once as a debit, and once as an exchange.E:twice, both times as debit.答案:C3.国际投资头寸表中资产项包括:()A:直接投资B:储备资产C:其他投资D:证券投资E:金融衍生工具答案:ABCDE4.一国的Net Foreign Assets其实就是历年的经常账户的累计值。

()A:错B:对答案:B5.国际收支的一次收入项是列在资本与金融账户下的。

()A:对B:错答案:B第二章测试1.如果商品价格不变,美元对英镑的贬值会导致:()A:美国的牛仔裤在英国更贵B:不改变毛衣和牛仔裤的相对价格C:英国的毛衣用牛仔裤表示的价格下降D:美国的牛仔裤用毛衣表示的价格下降答案:D2.如果一条在美国卖60美元的牛仔裤在伦敦卖30英镑,在一价定律成立的条件下,美元对英镑的汇率是()。

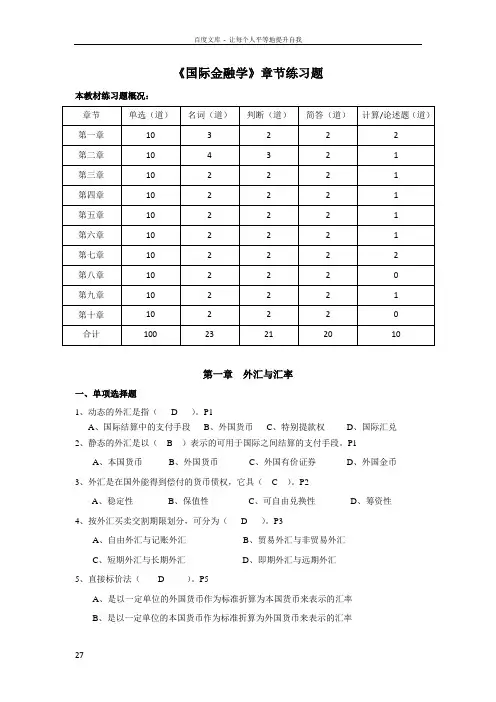

《国际金融学》章节练习题本教材练习题概况:第一章外汇与汇率一、单项选择题1、动态的外汇是指( D )。

P1A、国际结算中的支付手段B、外国货币C、特别提款权D、国际汇兑2、静态的外汇是以( B )表示的可用于国际之间结算的支付手段。

P1A、本国货币B、外国货币C、外国有价证券D、外国金币3、外汇是在国外能得到偿付的货币债权,它具( C )。

P2A、稳定性B、保值性C、可自由兑换性D、筹资性4、按外汇买卖交割期限划分,可分为( D )。

P3A、自由外汇与记账外汇B、贸易外汇与非贸易外汇C、短期外汇与长期外汇D、即期外汇与远期外汇5、直接标价法( D )。

P5A、是以一定单位的外国货币作为标准折算为本国货币来表示的汇率B、是以一定单位的本国货币作为标准折算为外国货币来表示的汇率C、是以美元为标准来表示各国货币的价格D、是以一定单位的本国货币作为标准折算为一定数额的外国货币来表示的汇率6、若某日外汇市场上A银行报价如下:美元/日元:欧元/美元:Z先生要向A银行购入1欧元,要支付多少日元( A )?P5A、B、143.7956 C、D、7、若某日外汇市场上A银行报价如下:美元/日元:美元/加元:Z先生要向A银行卖出10000日元,能获得多少加元( D )?P5A、B、72.20 C、D、8、金本位制下汇率的决定基础是( B )。

P9A、金平价B、铸币平价C、绝对购买力平价D、相对购买力平价9、利率对汇率的变动影响有( C )。

P12A、利率上升,本国汇率上升B、利率下降,本国汇率下降A、需比较国外汇率及本国的通货膨胀率而定D、无法确定10、人民币自由兑换的含义是( A )。

P17A、经常项目的交易中实现的人民币自由兑换B、资本项目的交易中实现的人民币自由兑换C、国内公民个人实现的人民币自由兑换D、经常项目和资本项目下都实现的人民币自由兑换二、名词解释题1、固定汇率:是指一国货币对另一国货币的汇率基本固定,同时将汇率的变动幅度限制在一个规定的较小范围内。

浙大远程国际金融学在线作业您的本次作业分数为:100分单选题1.我国实行经常项目下人民币可自由兑换,符合国际货币基金组织:∙ A 第五会员国规定∙ B 第十二会员国规定∙ C 第八会员国规定∙ D 第七会员国规定正确答案:C单选题2.与金币本位制度相比,金块本位和金汇兑本位对汇率的稳定程度已:∙ A 升高∙ B 降低∙ C 不变∙ D 无法比较正确答案:B单选题3.在典型的国际金本位制下,最重要的国际储备形式是:∙ A 外汇储备∙ B 黄金储备∙ C 在IMF的储备头寸∙ D 特别提款权正确答案:B单选题4.在汇率标价上,采用间接标价法的国家有:∙ A 英国与法国∙ B 英国与美国∙ C 美国与德国∙ D 美国与德国正确答案:B单选题5.外汇市场的基本汇率是:∙ A 电汇汇率∙ B 信汇汇率∙ C 票汇汇率∙ D 远期汇率正确答案:A单选题6.金币本位制度下,汇率决定的基础是:∙ A 法定平价∙ B 铸币平价∙ C 通货膨胀率∙ D 纸币购买力正确答案:C单选题7.属于洲际性的国际金融组织是:∙ A 国际货币基金组织∙ B 国际复兴与开发银行∙ C 国际金融公司∙ D 亚洲开发银行正确答案:C单选题8.IMF规定,在国际收支统计中∙ A 进口商品以CIF价计算,出口商品以FOB价计算∙ B 进口商品以FOB价计算,出口商品以CIF价计算∙ C 进出口商品均按FOB价计算∙ D 进出口商品均按CIF价计算正确答案:C单选题9.布雷顿森林体系的基础是:∙ A 怀特计划∙ B 凯恩斯计划∙ C 布雷迪计划∙ D 贝克计划正确答案:A单选题10.国际金融公司的贷款对象是:∙ A 发达国家的垄断集团∙ B 发达国家的私营中小型生产企业∙ C 发展中国家的大型国有企业∙ D 发展中国家的私营中小型生产企业正确答案:D单选题11.会员国向IMF借取普通贷款的最高限额为会员国所缴份额的:∙ A 105%∙ B 115%∙ C 125%∙ D 135%正确答案:C单选题12.防止外汇风险的平衡法是组成与应付(付)外币的()资金流动:∙ A 货币种类不同,金额相当,不同时间,相反方向∙ B 货币种类相同、金额相同、相同时间、相同方向∙ C 货币种类相同、金额相同、相同时间、相反方向∙ D 货币种类不同、金额相当、相同时间、相反方向正确答案:C单选题13.金额较低、期限较短的欧洲中长期贷款一般采用:∙ A 银团贷款∙ B 辛迪加贷款∙ C 双边贷款∙ D 其它形式正确答案:C单选题14.世行的贷款期限,最长可达:∙ A 10年∙ B 25年∙ C 30年∙ D 50年正确答案:C单选题15.在国际储备结构管理中,各国货币当局应更重视:∙ A 收益性∙ B 安全性∙ C 流动性∙ D 可偿性正确答案:C单选题16.当处于通货膨胀与国际收支逆差的经济状况时,应采用下列政策搭配:∙ A 紧缩国内支出,本币升值∙ B 扩张国内支出,本币贬值∙ C 扩张国内支出,本币升值∙ D 紧缩国内支出,本币贬值正确答案:D单选题17.面值为1000元的美元债券,其市场价值为1200元,这表明市场利率相对债券的票面利率:∙ A 较高∙ B 较低∙ C 相等∙ D 无法判断正确答案:B单选题18.一国在一定时期内同其他国家或地区之间资本流动总的情况主要反映在该国国际收支平衡表中的:∙ A 商品和劳务∙ B 经常项目∙ C 资本与金融项目∙ D 平衡项目正确答案:C单选题19.如果一国的贸易和非贸易汇率相对稳定,而金融汇率听任市场供求关系决定,这通常是:∙ A 固定汇率∙ B 浮动汇率∙ C 管理浮动汇率∙ D 复汇率制正确答案:D单选题20.世行目前最主要的贷款是:∙ A 项目贷款∙ B “第三窗口”贷款∙ C 技术援助贷款∙ D 联合贷款正确答案:A单选题21.我国的外汇结、售汇制度起源于:∙ A 建国初期∙ B 全面计划经济时期∙ C 改革开放以后∙ D 1994年的外汇体制改革正确答案:A单选题22.人民币自由兑换的含义是:∙ A 经常项目的交易中实现人民币自由兑换∙ B 资本项目的交易中实现人民币自由兑换∙ C 国内公民个人实现人民币自由兑换∙ D 国内企业实现人民币自由兑换正确答案:A单选题23.在二战前,构成各国国际储备的是:∙ A 黄金与可兑换为黄金的外汇∙ B 黄金与储备头寸∙ C 黄金与特别提款权∙ D 外汇储备与特别提款权正确答案:A单选题24.在汇率理论中,具有强烈的政策性和可操作性的是:∙ A 购买力平价说∙ B 利率平价说∙ C 货币主义说∙ D 资产结构说正确答案:C单选题25.某国际企业拥有一笔美元应收账款,且预测美元将要贬值,防止汇率风险可采取下列哪种方法:∙ A 提前收取这笔美元应收账款∙ B 推后收取这笔美元应收账款∙ C 签订一份买进等额美元的远期外汇合约∙ D 签订一份买进等额美元的外汇期货合约正确答案:A单选题26.即期外汇业务,是在外汇买卖成交以后,原则上办理交割的期限应在:∙ A 一天内∙ B 两天内∙ C 三天内∙ D 四天内正确答案:B单选题27.国际清偿力是一国具有的:∙ A 国际储备∙ B 现实的对外清偿能力∙ C 可能的对外清偿能力∙ D 现实和可能的对外清偿能力之和正确答案:D单选题28.目前在IMF会员国的国际储备中,最重要的国际储备形式是:∙ A 黄金储备∙ B 外汇储备∙ C 在IMF的储备头寸∙ D 特别提款权正确答案:B单选题29.主要研究货币贬值对贸易收支的影响的国际收支调节理论是:∙ A 物价现金流动机制∙ B 弹性分析理论∙ C “米德冲突”及协调理论∙ D 自动调节理论正确答案:B单选题30.标志着布雷顿森林体系崩溃的开始的事件是:∙ A 互惠信贷协议∙ B 黄金双价制∙ C 尼克松政府的新经济政策∙ D 史密森氏协议正确答案:B单选题31.防止进口付汇风险最好的方法是:∙ A 以预测下浮趋势最强的一种货币作为计价货币∙ B 以预测下浮趋势较强的两种货币作为计价货币∙ C 以预测具有下浮趋势的多种货币作为计价货币∙ D 以欧元作为计价货币正确答案:C单选题32.有外币债权或债务的公司,与银行签订购买或出售远期外汇的合同是哪种保值法:∙ A 货币期货合同∙ B 货币期权合同∙ C 即期合同∙ D 远期合同正确答案:D单选题33.“马歇尔——勒纳条件”是指:∙ A 进口需求弹性与出口需求弹性之和大于1∙ B 进口需求弹性与出口需求弹性之和大于0∙ C 进口需求弹性与出口需求弹性之和小于1∙ D 进口需求弹性与出口需求弹性之和小于0正确答案:A单选题34.外汇风险管理方法中,有一种被称为“即期外汇交易法”,它是:∙ A 用与现行风险头寸货币种类不同、金额相当、资金流向相反的外汇交易来消除外汇风险∙ B 只能消除协议后两个营业日外汇汇率变动给企业带来的外汇风险∙ C 可以消除远期负债带来的远期外汇风险∙ D 在使用过程中,企业支付结算的日期与外汇交易的交割日不一定在同一时刻正确答案:B单选题35.欧洲货币市场的币种交易中比重最大的是:∙ A 欧洲美元∙ B 欧洲英镑∙ C 欧洲马克∙ D 欧洲日元正确答案:A单选题36.历史上第一个国际货币体系是:∙ A 国际金汇兑本位制∙ B 国际金本位制∙ C 布雷顿森林体系∙ D 牙买加体系正确答案:B单选题37.我国的国际储备管理主要是:∙ A 黄金储备管理∙ B 外汇储备管理∙ C 储备头寸管理∙ D 特别提款权管理正确答案:B单选题38.外汇管理最核心的内容是:∙ A 外汇资金收入和运用的管理∙ B 货币兑换管理∙ C 汇率管理∙ D 外债管理正确答案:B单选题39.企业可以通过选择适当的结算方式来降低外汇风险,假设目前可供选择的结算方式有:信用证(即期、远期)、托收、汇款。

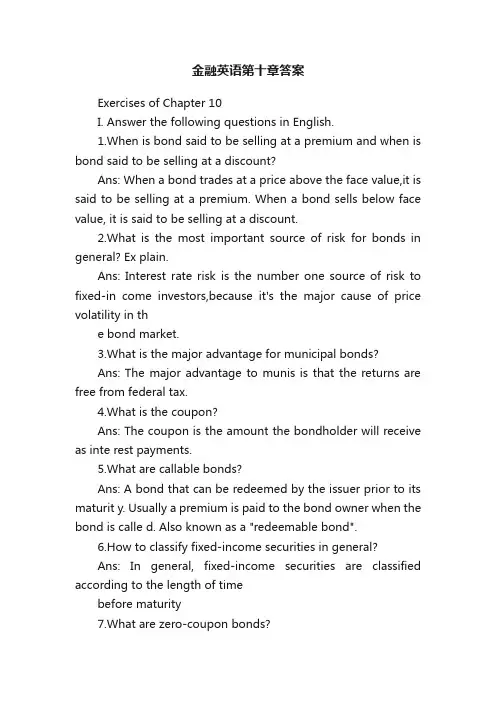

金融英语第十章答案Exercises of Chapter 10I. Answer the following questions in English.1.When is bond said to be selling at a premium and when is bond said to be selling at a discount?Ans: When a bond trades at a price above the face value,it is said to be selling at a premium. When a bond sells below face value, it is said to be selling at a discount.2.What is the most important source of risk for bonds in general? Ex plain.Ans: Interest rate risk is the number one source of risk to fixed-in come investors,because it's the major cause of price volatility in the bond market.3.What is the major advantage for municipal bonds?Ans: The major advantage to munis is that the returns are free from federal tax.4.What is the coupon?Ans: The coupon is the amount the bondholder will receive as inte rest payments.5.What are callable bonds?Ans: A bond that can be redeemed by the issuer prior to its maturit y. Usually a premium is paid to the bond owner when the bond is calle d. Also known as a "redeemable bond".6.How to classify fixed-income securities in general?Ans: In general, fixed-income securities are classified according to the length of timebefore maturity7.What are zero-coupon bonds?Ans: This is a type of bond that makes no coupon payments but instead is issued at aconsiderable discount to par value.8.What do bond brokers do for investors?Ans: A full service or discount brokerageⅡ. Fill in the each blank with an appropriate word o r expression.l. Interest Rate Risk is the number one source of risk to fixed-incom e investors,because it's the ( major )cause of price volatility in the bond market.2.In the ( case )of bonds, interest rate risk translates ( into ) marketrisk: The behavior of interest rate, in general, affects all bond s and cuts( across ) all sectors of the market-even the U.S. Treasury mar ket.3. When market interest rates rise, bond prices fall, and vice ver sa. And asinterest rates become more volatile,( so ) do bond prices.4. This is a type of bond that makes no coupon payments but( ins tead )isissued at a considerable discount to par value. For example, let's say a zero-coupon bond with a $1 000 par value and 10 years to maturity is( trading )at $ 600; you'd be paying $ 600 ( today )for a bond that wil l be worth$1 000 in 10 years.5. Bonds have a ( number )of characteristics of which youneed to be aware.All of these factors play a role in determining the value of a b ond and theextent to( which )it fits in your portfolio.6. In general, fixed-income securities are classified( according to )the length of timebefore maturity. These are the three main categories.III. Translate the following sentences into English.l.债券买卖是指交易双方以约定的价格买卖一定金额的债券并在规定的清算时间内办理债券款项交割的交易方式。

浙大国际金融学第10章的答案10金融危机与金融危机的防范综合练习题一、多项选择题*1、金融危机的传播效应包括(ABD )A.季风效应B.溢出效应C.净传染效应D.羊群效应E.接触效应2、金融危机国际传染中的实体经济路径包括(AD )A.竞争对手型传染B.金融机构型传染C.投资者信心传染D.贸易伙伴型传染E.资本市场型传染二、名词解释1、金融危机: 是指一个国家或几个国家与地区的全部或大部分金融指标(如:短期利率、货币资产、证券、房地产、土地价格、商业破产数和金融机构倒闭数)的急剧、短暂和超周期的恶化。

2、货币危机: 货币危机概念有狭义、广义之分。

狭义的货币危机与特定的汇率制度(通常是固定货币危机汇率制)相对应,其含义是,实行固定汇率制的国家,在非常被动的情况下(如在经济基本面恶化的情况下,或者在遭遇强大的投机攻击情况下),对本国的汇率制度进行调整,转而实行浮动汇率制,而由市场决定的汇率水平远远高于原先所刻意维护的水平(即官方汇率),这种汇率变动的影响难以控制、难以容忍,这一现象就是货币危机。

广义的货币危机泛指汇率的变动幅度超出了一国可承受的范围这一现象。

3、银行危机: 银行危机是指银行过度涉足(或贷款给企业)从事高风险行业(如房地产、股票),从而导致资产负债严重失衡,呆账负担过重而使资本运营呆滞而破产倒闭的危机。

4、外债危机: 是指在国际借贷领域中大量负债,超过了借款者自身的清偿能力,造成无力还债或必须延期还债的现象。

三、简答题1、请分析金融危机的传播效应。

答:从经济学和管理学的角度来看,危机给中国传媒业带来三大效应。

“蝴蝶效应”着眼于对立足点的定位,“乘数效应”强调了效果的放大,而“牛鞭效应”预示了传导过程中的变异。

2、20世纪80年代国际债务危机产生的原因是什么?如何解决?答:导致债务危机的原因80年代债务危机爆发的原因十分复杂。

归纳起来看,主要有以下6点原因:①1973~1974年和1979~1980年两次石油提价导致许多国家国际收支出现创纪录的逆差,同时发展中国家中的一些产油国则出现巨额顺差。

《国际金融》课后习题答案第一章国际收支本章重要概念国际收支:国际收支是指一国或地区居民与非居民在一定时期全部经济交易的货币价值之和。

它体现的是一国的对外经济交往,是货币的、流量的、事后的概念。

国际收支平衡表:国际收支平衡表是将国际收支根据复式记账原则和特定账户分类原则编制出来的会计报表。

它可分为经常项目、资本和金融项目以及错误和遗漏项目三大类。

丁伯根原则:1962 年,荷兰经济学家丁伯根在其所著的《经济政策:原理与设计》一书中提出:要实现若干个独立的政策目标,至少需要相互独立的若干个有效的政策工具。

这一观点被称为“丁伯根原则”。

米德冲突:英国经济学家米德于1951 年在其名著《国际收支》当中最早提出了固定汇率制度下外均衡冲突问题。

米德指出,如果我们假定失业与通货膨胀是两种独立的情况,那么,单一的支出调整政策(包括财政、货币政策)无法实现部均衡和外部均衡的目标。

分派原则:这一原则由蒙代尔提出,它的含义是:每一目标应当指派给对这一目标有相对最大的影响力,因而在影响政策目标上有相对优势的工具。

自主性交易:亦称事前交易,是指交易当事人自主地为某项动机而进行的交易。

国际收支失衡:国际收支失衡是指自主性交易发生逆差或顺差,需要用补偿性交易来弥补。

它有不同的分类,根据时间标准进行分类,可分为静态失衡和动态失衡;根据国际收支的容,可分为总量失衡和结构失衡;根据国际收支失衡时所采取的经济政策,可分为实际失衡和潜在失衡。

复习思考题1.一国国际收支平衡表的经常账户是赤字的同时,该国的国际收支是否可能盈余,为什么?答:可能,通常人们所讲的国际收支盈余或赤字就是指综合差额的盈余或赤字.这里综合差额的盈余或赤字不仅包括经常账户,还包括资本与金融账户,这里,资本与金融账户和经常账户之间具有融资关系。

但是,随着国际金融一体化的发展,资本和金融账户与经常账户之间的这种融资关系正逐渐发生深刻变化。

一方面,资本和金融账户为经常账户提供融资受到诸多因素的制约。

《国际金融学》习题与答案《国际金融学》习题与答案.txt当你以为自己一无所有时,你至少还有时间,时间能抚平一切创伤,所以请不要流泪。

能满足的期待,才值得期待;能实现的期望,才有价值。

保持青春的秘诀,是有一颗不安分的心。

不是生活决定何种品位,而是品位决定何种生活。

《国际金融学》习题答案《国际金融学》习题答案一、简答题1、国际收支平衡表的编制原理是什么?(1)记帐制度——复式簿记原理。

记账规则:有借必有贷,借贷必相等。

入表原则:凡是引起外汇流出的项目记入该项目的借方,凡是引起外汇流入的项目记入该项目的贷方。

(2)交易的记载时间。

IMF建议采用“权责发生制”,即所有权变更原则。

(3)记帐单位,国际收支平衡表一般按外币记载。

(4)定值(Valuation)在可以得到市场价格的情况下,按市场价格对交易定值债务工具大多按面值定值货物出口按离岸价格(FOB)定值来自海关的进口数据是到岸价格(CIF)数据,采用5%的调整系数,以得到离岸价格(FOB)数据。

2、国际收支平衡表的分析方法有哪些?(1)静态分析。

静态分析是对某一国一个时期的国际收支平衡表进行逐项,细致的分析。

包括:贸易差额;劳务差额;经常项目差额;基本差额;国际收支总差额。

(2)动态分析。

动态分析是对某国若干连续时期的国际收支平衡表进行分析。

动态分析实际上是对一国的国际收支进行纵向分析。

(3)比较分析。

比较分析是对不同国家同一时期的国际收支平衡表进行分析比较.将某一国某个时期的国际收支平衡表与其他国家进行对比,可以了解该国的国际经济地位和经济实力。

3、国际收支失衡的主要原因是什么?引起一国国际收支失衡的原因很多,概括起来主要有临时性因素、收入性因素、货币性因素、周期性因素和结构性因素。

(1)临时性失衡。

临时性失衡是指各国短期的、由非确定或偶然因素引起的国际收支失衡。

自然灾害、政局变化等意料之外的因素都可能对国际收支产生重大的影响。

(2)收入性失衡。

收入性失衡是指各国经济增长速度不同所引起的国际收支失衡。

马歇尔-勒纳条件:如果一国处于贸易逆差中,会引起本币贬值,本币贬值会改善贸易逆差,但需要的具体条件是进出口需求弹性之和大于1,即(Dx+Di)>1外汇:狭义的外汇是指以外币表示的用于国际债权债务结算的支付手段。

间接标价法:用1个单位或100个单位的本国货币作为基准折算成一定数额的外国货币J型曲线效应:在现实中,货币贬值导致贸易差额的最终改善需要一个“收效期”,收效快慢取决于供求反应程度高低,并且在汇率变化的收效期内会出现短期的国际收支恶化现象。

这种现象用曲线表现成丁字形。

自由兑换货币:指该货币是国际交易中被广泛使用的支付货币;该货币是主要外汇市场上普遍进行交易(买卖)的货币。

离岸金融市场:是指主要为非居民提供境外货币借贷或投资,贸易结算,外汇黄金买卖,保险服务及证券交易等金融业务和服务的一种国际金融市场。

IBF:是指国际银行设施,是在美国境内的美国银行或外国银行开立的经营欧洲货币和欧洲美元的账户,此体系资产独立于总财产分开。

欧洲货币市场:在一国境外进行该国货币借贷的国际市场。

票据发行便利:票据发行便利是银行与借款人之间签定的在未来的一段时间内由银行以承购连续性短期票据的形式向借款人提供信贷资金的协议,协议具有法律约束力。

远期利率协定:指交易双方在未来的结算日,针对某一特定主义本金,参照贴现原则,就协议利率与参考利率差额进行支付的远期合作。

择期:是指远期外汇的购买者(或出卖者)在合约的有效期内任何一天,有权要求银行实行交割的一种业务。

交易风险:经营活动中的风险,也称转换风险,主要指由于汇率变化而引起资产负债表中某些外汇项目金额变动的风险。

折算风险:又称会计风险。

是指是经营活动中的风险,主要指由于汇率变化而引起资产负债表中某些外汇项目金额变动的风险。

经济风险:又称经营风险,是预期经营收益的风险,只有与外汇汇率发生波动而引起国际企业未来收益变化的一种潜在的风险。

购买力评价说:两国货币的汇率主要是有两国货币的购买力决定的。

浙大国际金融在线作业1单选题1.IMF规定,在国际收支统计中•• A 进口商品以CIF价计算,出口商品以FOB价计算•• B 进口商品以FOB价计算,出口商品以CIF价计算•• C 进出口商品均按FOB价计算•• D 进出口商品均按CIF价计算正确答案:C单选题2.在国际收支平衡表中,下列各项属于单方面转移的是•• A 保险赔偿金•• B 专利费•• C 投资收益•• D 政府间债务减免正确答案:D单选题3.在国际收支平衡表中,人为设立的项目是•• A 官方储备•• B 分配的特别提款权•• C 经常转移•• D 错误与遗漏正确答案:D单选题4.下列项目应记入贷方的是•• A 从外国获得的商品和劳务•• B 向外国政府或私人提供的援助、捐赠•• C 国内私人国外资产的减少或国外负债的增加•• D 国内官方当局的国外资产的增加或国外负债的减少正确答案:C单选题5.综合项目差额是指•• A 经常项目差额与资本与金融项目差额之和•• B 经常项目差额与资本与金融项目中扣除官方储备后差额之和•• C 经常项目差额与金融项目差额之和•• D 经常项目差额与资本项目差额之和正确答案:B单选题6.国际收支不平衡是•• A 自主性交易不平衡•• B 调节性交易不平衡•• C 自主性交易和调节性交易都不平衡•• D 经常项目不平衡正确答案:A单选题7.最早论述“物价现金流动机制”理论的是•• A 马歇尔•• B 休谟·大卫•• C 弗里德曼•• D 凯恩斯正确答案:B单选题8.在典型的国际金本位制下,最重要的国际储备形式是:•• A 外汇储备•• B 黄金储备•• C 在IMF的储备头寸•• D 特别提款权正确答案:B单选题9.目前在IMF会员国的国际储备中,最重要的国际储备形式是:•• A 黄金储备•• B 外汇储备•• C 在IMF的储备头寸•• D 特别提款权正确答案:B单选题10.在二战前,构成各国国际储备的是:•• A 黄金与可兑换为黄金的外汇•• B 黄金与储备头寸•• C 黄金与特别提款权•• D 外汇储备与特别提款权正确答案:A单选题11.二战后,最主要的国际储备货币是:•• A 英镑•• B 日元•• C 美元•• D 马克正确答案:C单选题12.在国际储备结构管理中,各国货币当局应更重视:•• A 收益性•• B 安全性•• C 流动性•• D 可偿性正确答案:C单选题13.“马歇尔——勒纳条件”是指:•• A 进口需求弹性与出口需求弹性之和大于1•• B 进口需求弹性与出口需求弹性之和大于0•• C 进口需求弹性与出口需求弹性之和小于1D进口需求弹性与出口需求弹性之和小于0正确答案:A单选题14.我国的国际储备管理主要是:•• A 黄金储备管理•• B 外汇储备管理•• C 储备头寸管理•• D 特别提款权管理正确答案:B单选题15.在典型的国际金本位制下,最重要的国际储备形式是:•• A 外汇储备•• B 黄金储备•• C 在IMF的储备头寸•• D 特别提款权正确答案:B单选题16.当处于通货膨胀与国际收支逆差的经济状况时,应采用下列政策搭配:•• A 紧缩国内支出,本币升值• B 扩张国内支出,本币贬值•• C 扩张国内支出,本币升值•• D 紧缩国内支出,本币贬值正确答案:D单选题17.一国的国际储备额同进口额之间适当的比例关系为:•• A 40%-50%•• B 20%-40%•• C 50%-60%•• D 10%-30%正确答案:B单选题18.国际清偿力是一国具有的:•• A 国际储备•• B 现实的对外清偿能力•• C 可能的对外清偿能力•• D 现实和可能的对外清偿能力之和正确答案:D单选题19.主要研究货币贬值对贸易收支的影响的国际收支调节理论是:•• A 物价现金流动机制•• B 弹性分析理论• C “米德冲突”及协调理论•• D 自动调节理论正确答案:B单选题20.一国货币汇率上升,则会有利于:•• A 进口•• B 出口•• C 增加就业•• D 扩大生产正确答案:A单选题21.与金币本位制度相比,金块本位和金汇兑本位对汇率的稳定程度已:•• A 升高•• B 降低•• C 不变•• D 无法比较正确答案:B单选题22.利率对汇率变动的影响是:•• A 利率上升,本国汇率上升•• B 利率下降,本国汇率下降•• C 须比较国外利率及本国的通货膨胀率后而定• D 利率与汇率不存在联动关系正确答案:B单选题23.在汇率标价上,采用间接标价法的国家有:•• A 英国与法国•• B 英国与美国•• C 美国与德国•• D 美国与德国正确答案:B单选题24.金币本位制度下,汇率决定的基础是:•• A 法定平价•• B 铸币平价•• C 通货膨胀率•• D 纸币购买力正确答案:C单选题25.在汇率理论中,具有强烈的政策性和可操作性的是:•• A 购买力平价说•• B 利率平价说•• C 货币主义说•• D 资产结构说正确答案:C单选题26.英镑的年利率为27%,美元的年利率为9%,假如一家美国公司投资英镑1年,为符合利率平价,英镑应相对美元:•• A 升值18%•• B 贬值14%•• C 升值14%•• D 贬值8.5%正确答案:B多选题27.储备货币必须具备的基本特征是:•• A 必须是可兑换货币•• B 必须为各国普遍接受•• C 价值相对稳定•• D 必须与黄金保持固定的比价关系•• E 必须与特别提款权保持固定比价关系正确答案:ABC多选题28.目前交易量具有国际影响的外汇市场主要有:•• A 伦敦•• B 纽约•• C 上海•• D 东京•• E 台北正确答案:ABD多选题29.从供给角度讲,调节国际收支的政策有:•• A 财政政策•• B 产业政策•• C 科技政策•• D 货币政策•• E 融资政策正确答案:BC多选题30.营业时间相互衔接而使国际外汇市场成为一天连转的市场有:•• A 西欧外汇市场•• B 纽约•• C 东京•• D 芝加哥•• E 新加坡正确答案:ABD多选题31.国际收支的长期性不平衡是指:•• A 暂时性不平衡•• B 结构性不平衡• C 货币性不平衡•• D 周期性不平衡•• E 收入性不平衡正确答案:BE多选题32.下列项目中属于自主性交易的是:•• A 经常项目•• B 资本项目•• C 证券投资项目•• D 官方储备项目•• E 错误与遗漏项目正确答案:ABC多选题33.当前影响一国汇率变动的主要因素有:•• A 经济状况•• B 国际收支状况•• C 利率水平•• D 研发投入•• E 重大的国际政治因素正确答案:ABC多选题34.汇率下浮与物价水平的关系可用下列机制来解释:• A 货币工资机制•• B 生产成本机制•• C 货币供应机制•• D 收入机制•• E 债务效应正确答案:ABCD多选题35.在教学计划中课程类别有:•• A 公共必修•• B 专业必修•• C 专业选修•• D 公共选修正确答案:ABD多选题36.当前影响一国汇率变动的主要因素有:•• A 经济状况•• B 国际收支状况•• C 利率水平•• D 货币政策•• E 重大的国际政治因素正确答案:ABCDE多选题37.外汇风险的防止可以采取下列哪些方法:•• A 优化货币组合•• B 签订保值条款•• C 选好结算方式•• D 投资业务•• E 放弃国外市场正确答案:ABD多选题38.可能导致远期汇率与即期汇率的差异完全超过两地利率水平差的因素有:•• A 货币法定贬值政策•• B 力量较强的外汇投机活动•• C 重大的政治事件•• D 国际形势突变•• E 货币法定升值政策正确答案:ABCDE多选题39.一国国际储备的来源渠道有:•• A 国际收支顺差•• B 中央银行针对本币升值的外汇干预活动•• C IMF分配的特别提款权•• D 中央银行在国内收购黄金•• E 政府或中央银行向国外借款净额正确答案:ABDE多选题40.既可以消除外汇时间风险也可以消除价值风险的做法有:•• A 借款法•• B 远期合同法•• C 即期合同法•• D 掉期合同法•• E 期货合同法正确答案:BCDE多选题41.远期外汇市场上的参加人有:•• A 进口商•• B 出口商•• C 负有短期外币债务的债务人•• D 持有外币债权的债权人•• E 牟利者与投机商正确答案:ABCDE多选题42.世界主要金融中心目前主要经营外汇金融业务有:•• A 货币期货•• B 外币期权•• C 政府债券期货• D 证券指数期货•• E 欧洲美元存款期货正确答案:ABCDE加入错题集关闭(本资料素材和资料部分来自网络,仅供参考。

国际金融习题答案全 The pony was revised in January 2021第一章三、名词解释1、国际收支:在一定时期内,一国居民与非居民之间经济交易的系统记录。

2、国际收支平衡表:一国将其一定时期内的全部国际经济交易,根据交易的内容与范围,按照经济分析的需要设置账户或项目编制出来的统计报表。

3、居民是指一个国家的经济领土内具有经济利益的经济单位。

在国际收支统计中判断一项交易是否应当包括在国际收支的范围内,所依据的不是交易双方的国籍,而是依据交易双方是否有一方是该国居民。

4、一国的经济领土:一般包括一个政府所管辖的地理领土,还包括该国天空、水域和邻近水域下的大陆架,以及该国在世界其他地方的飞地。

依照这一标准,一国的大使馆等驻外机构是所在国的非居民,而国际组织是任何国家的非居民。

5、经常账户:是指对实际资源在国际间的流动行为进行记录的账户,它包括以下项目:货物、服务、收入和经常转移。

反映进口实际资源的记人经常项目借方;反映出口实际资源的记人经常项目贷方。

6、经常转移包括各级政府的转移(如政府间经常性的国际合作、对收入和财政支付的经常性税收等)和其他转移(如工人汇款)。

当一个经济体的居民实体向另一个非居民实体无偿提供了实际资源或金融产品时,按照复式记账法原理,需要在另一方进行抵消性记录以达到平衡,也就是需要建立转移账户作为平衡项目。

7、贸易收支:又称有形贸易收支,是国际收支中的一个项目,指由商品输出入所引起的收支。

出口记为贷方,进口记为借方。

IMF规定,在国际收支的统计工作中,进出口商品都以离岸价格(FOB)计算。

若进口商品以到岸价格(CIF)计算时,应把货价中的运费、保险费等贸易的从属费用减除,然后列入劳务收支项目中。

8、服务交易:是经常账户的第二个大项目,它包括运输、旅游以及在国际贸易中的地位越来越重要的其他项目,如通讯、金融、计算机服务、专有权征用和特许以及其他商业服务。

将服务交易同收入交易明确区分开来是《国际收支手册》第五版的重要特征。

第一章三、名词解释1、国际收支:在一定时期内,一国居民与非居民之间经济交易的系统记录。

2、国际收支平衡表:一国将其一定时期内的全部国际经济交易,根据交易的内容与范围,按照经济分析的需要设置账户或项目编制出来的统计报表。

3、居民是指一个国家的经济领土内具有经济利益的经济单位。

在国际收支统计中判断一项交易是否应当包括在国际收支的范围内,所依据的不是交易双方的国籍,而是依据交易双方是否有一方是该国居民。

4、一国的经济领土:一般包括一个政府所管辖的地理领土,还包括该国天空、水域和邻近水域下的大陆架,以及该国在世界其他地方的飞地。

依照这一标准,一国的大使馆等驻外机构是所在国的非居民,而国际组织是任何国家的非居民。

5、经常账户:是指对实际资源在国际间的流动行为进行记录的账户,它包括以下项目:货物、服务、收入和经常转移。

反映进口实际资源的记人经常项目借方;反映出口实际资源的记人经常项目贷方。

6、经常转移包括各级政府的转移(如政府间经常性的国际合作、对收入和财政支付的经常性税收等)和其他转移(如工人汇款)。

当一个经济体的居民实体向另一个非居民实体无偿提供了实际资源或金融产品时,按照复式记账法原理,需要在另一方进行抵消性记录以达到平衡,也就是需要建立转移账户作为平衡项目。

7、贸易收支:又称有形贸易收支,是国际收支中的一个项目,指由商品输出入所引起的收支。

出口记为贷方,进口记为借方。

IMF规定,在国际收支的统计工作中,进出口商品都以离岸价格(FOB)计算。

若进口商品以到岸价格(CIF)计算时,应把货价中的运费、保险费等贸易的从属费用减除,然后列入劳务收支项目中。

8、服务交易:是经常账户的第二个大项目,它包括运输、旅游以及在国际贸易中的地位越来越重要的其他项目,如通讯、金融、计算机服务、专有权征用和特许以及其他商业服务。

将服务交易同收入交易明确区分开来是《国际收支手册》第五版的重要特征。

9、收入交易:包括居民和非居民之间的两大类交易:①支付给非居民工人(例如季节性的短期工人)的职工报酬;②投资收入项下有关对外金融资产和负债的收入和支出。

习题答案第一章国际收支本章重要概念国际收支:国际收支是指一国或地区居民与非居民在一定时期内全部经济交易的货币价值之和。

它体现的是一国的对外经济交往,是货币的、流量的、事后的概念。

国际收支平衡表:国际收支平衡表是将国际收支根据复式记账原则和特定账户分类原则编制出来的会计报表。

它可分为经常项目、资本和金融项目以及错误和遗漏项目三大类。

丁伯根原则:1962 年,荷兰经济学家丁伯根在其所著的《经济政策:原理与设计》一书中提出:要实现若干个独立的政策目标,至少需要相互独立的若干个有效的政策工具。

这一观点被称为“丁伯根原则”。

米德冲突:英国经济学家米德于1951 年在其名著《国际收支》当中最早提出了固定汇率制度下内外均衡冲突问题。

米德指出,如果我们假定失业与通货膨胀是两种独立的情况,那么,单一的支出调整政策(包括财政、货币政策)无法实现内部均衡和外部均衡的目标。

分派原则:这一原则由蒙代尔提出,它的含义是:每一目标应当指派给对这一目标有相对最大的影响力,因而在影响政策目标上有相对优势的工具。

自主性交易:亦称事前交易,是指交易当事人自主地为某项动机而进行的交易。

国际收支失衡:国际收支失衡是指自主性交易发生逆差或顺差,需要用补偿性交易来弥补。

它有不同的分类,根据时间标准进行分类,可分为静态失衡和动态失衡;根据国际收支的内容,可分为总量失衡和结构失衡;根据国际收支失衡时所采取的经济政策,可分为实际失衡和潜在失衡。

【复习思考题】1一国国际收支平衡表的经常账户是赤字的同时,该国的国际收支是否可能盈余,为什么?答:可能,通常人们所讲的国际收支盈余或赤字就是指综合差额的盈余或赤字.这里综合差额的盈余或赤字不仅包括经常账户,还包括资本与金融账户,这里,资本与金融账户和经常账户之间具有融资关系。

但是,随着国际金融一体化的发展,资本和金融账户与经常账户之间的这种融资关系正逐渐发生深刻变化。

一方面,资本和金融账户为经常账户提供融资受到诸多因素的制约。

国际⾦融学期末复习(部分答案)⼀.名词解释1. ⽶德冲突是指在许多情况下,单独使⽤⽀出调整政策或⽀出转换政策追求内、外部均衡,将会导致⼀国内部均衡与外部均衡之间的冲突。

这⼀冲突就是著名的⽶德冲突。

2. 丁伯根原则——由丁伯根提出的关于国家经济调节政策和经济调节⽬标之间关系的法则。

其基本内容是:政策⼯具的数量或控制变量数⾄少要等于⽬标变量的数量;⽽且这些政策⼯具必须是相互独⽴(线性⽆关)的。

3. Interest Arbitrag(套利)指两种货币资⾦短期利率出现差异的情况下,将资⾦从低利率货币兑换成⾼利率货币,以赚取利差的外汇交易⾏为。

4. 外汇投机指根据对汇率变动的预期,有意保持某种外汇的多头或空头,希望从汇率变动中赚取利润的⾏为。

5.外国债券是指外国借款⼈在某国发⾏的、以该国货币表⽰⾯值的债券。

6. 互换是指⼀种双⽅商定在⼀段时间内彼此相互交换现⾦的⾦融交易。

7.有效市场分类原则指每⼀⽬标应指派给对这⼀⽬标有相对最⼤影响⼒、因⽽在影响政策⽬标上有相对优势的⼯具。

8.套汇是指同⼀货币汇率在不同外汇市场上发⽣差异到⼀定程度时,对⼀种货币在汇价较低的市场上买进,在汇价较⾼的市场上卖出以获得其中差额利益的⾏为。

9.欧洲债券是指在欧洲货币市场上发⾏、交易的债券,它⼀般是发⾏者在债券⾯值货币发⾏国意外的国家的⾦融市场上发⾏的。

10.Forward Rate Agreement (远期利率协议)远期利率协议是⼀种远期合约,买卖双⽅(客户与银⾏或两个银⾏同业之间)商定将来⼀定时间点(指利息起算⽇)开始的⼀定期限的协议利率,并规定以何种利率为参照利率,在将来利息起算⽇,按规定的协议利率、期限和本⾦额,由当事⼈⼀⽅向另⼀⽅⽀付协议利率与参照利率利息差的贴现额。

11.特⾥芬难题是指为满⾜世界各国发展经济的需要,美元供应必须不断增长,⽽美元供应的不断增长,使美元同黄⾦的兑换性⽇益难以维持。

12.外汇平准基⾦:中央银⾏拨出⼀定数量的外汇储备,作为外汇平准基⾦。

CHAPTER 12NA TIONAL INCOME ACCOUNTING AND THE BALANCE OF PA YMENTSANSWERS TO TEXTBOOK PROBLEMS1. The reason for including only the value of final goods and services in GNP, as stated in thequestion, is to avoid the problem of double counting. Double counting will not occur if intermediate imports are subtracted and intermediate exported goods are added to GNP accounts. Consider the sale of U.S. steel to Toyota and to General Motors. The steel sold to General Motors should not be included in GNP since the value of that steel is subsumed in the cars produced in the United States. The value of the steel sold to Toyota will not enter the national income accounts in a more finished state since the value of the Toyota goes towards Japanese GNP. The value of the steel should be subtracted from GNP in Japan since U.S. factors of production receive payment for it.2. Equation 2 can be written as CA = (S p - I) + (T - G). Higher U.S. barriers to imports mayhave little or no impact upon private savings, investment, and the budget deficit. If there were no effect on these variables then the current account would not improve with the imposition of tariffs or quotas. It is possible to tell stories in which the effect on the current account goes either way. For example, investment could rise in industries protected by the tariff, worsening the current account. (Indeed, tariffs are sometimes justified by the alleged need to give ailing industries a chance to modernize their plant and equipment.) On the other hand, investment might fall in industries that face a higher cost of imported intermediate goods as a result of the tariff. In general, permanent and temporary tariffs have different effects. The point of the question is that a prediction of the manner in which policies affect the current account requires a general-equilibrium, macroeconomic analysis.3. a. The purchase of the German stock is a debit in the U.S. financial account. There is acorresponding credit in the U.S. financial account when the American pays with a check on his Swiss bank account because his claims on Switzerland fall by the amount of the check.This is a case in which an American trades one foreign asset for another.b. Again, there is a U.S. financial account debit as a result of the purchase of a German stockby an American. The corresponding credit in this case occurs when the German seller deposits the U.S. check in its German bank and that bank lends the money to a German importer (in which case the credit will be in the U.S. current account) or to an individual or corporation that purchases a U.S. asset (in which case the credit will be in the U.S.financial account). Ultimately, there will be some action taken by the bank which results ina credit in the U.S. balance of payments.c. The foreign exchange intervention by the French government involves the sale of a U.S.asset, the dollars it holds in the United States, and thus represents a debit item in the U.S.financial account. The French citizens who buy the dollars may use them to buy American goods, which would be an American current account credit, or an American asset, which would be an American financial account credit.d. Suppose the company issuing the traveler’s check uses a checking account in France tomake payments. When this company pays the French restaurateur for the meal, its payment represents a debit in the U.S. current account. The company issuing the traveler’s checkmust sell assets (deplete its checking account in France) to make this payment. This reduction in the French assets owned by that company represents a credit in the American financial account.e. There is no credit or debit in either the financial or the current account since there has beenno market transaction.f. There is no recording in the U.S. Balance of Payments of this offshore transaction.4. The purchase of the answering machine is a current account debit for New Y ork, and acurrent account credit for New Jersey. When the New Jersey company deposits the money in its New Y ork bank there is a financial account credit for New Y ork and a corresponding debit for New Jersey. If the transaction is in cash then the corresponding debit for New Jersey and credit for New Y ork also show up in their financial accounts. New Jersey acquires dollar bills (an import of assets from New Y ork, and therefore a debit item in its financial account); New Y ork loses the dollars (an export of dollar bills, and thus a financial account credit). Notice that this last adjustment is analogous to what w ould occur under a gold standard (see Chapter 19).5. a. Since non-central bank capital inflows fell short of the current-account deficit by $500million, the balance of payments of Pecunia (official settlements balance) was -$500 million. The country as a whole somehow had to finance its $1 billion current-account deficit, so Pecunia's net foreign assets fell by $1 billion.b. By dipping into its foreign reserves, the central bank of Pecunia financed the portion of thecountry's current-account deficit not covered by private financial inflows. Only if foreign central banks had acquired Pecunian assets could the Pecunian central bank have avoided using $500 million in reserves to complete the financ ing of the current account. Thus, Pecunia's central bank lost $500 million in reserves, which would appear as an official financial inflow (of the same magnitude) in the country's balance of payments accounts.c. If foreign official capital inflows to Pecunia were $600 million, the country had a balanceof payments surplus of $100 million. Put another way, the country needed only $1 billion to cover its current-account deficit, but $1.1 billion flowed into the country. The Pecunian central bank must, therefore, have used the extra $100 million in foreign borrowing to increase its reserves. Purchases of Pecunian assets by foreign central banks enter their countries' balance of payments accounts as outflows, which are debit items. The rationale is that the transactions result in foreign payments to the Pecunians who sell the assets.d. Along with non-central bank transactions, the accounts would show an increase in foreignofficial reserve assets held in Pecunia of $600 million (a financial account credit, or inflow) and an increase Pecunian official reserve assets held abroad of $100 billion (a financial account debit, or outflow). Of course, total net financial inflows of $1 billion just cover the current-account deficit.6. A current account deficit or surplus is a situation which may be unsustainable in the longrun. There are instances in which a deficit may be warranted, for example to borrow today to improve productive capacity in order to have a higher national income tomorrow. But for any period of current account deficit there must be a corresponding period in whichspending falls short of income (i.e. a current account surplus) in order to pay the debts incurred to foreigners. In the absence of unusual investment opportunities, the best path for an economy may be one in which consumption, relative to income, is smoothed out over time.The reserves of foreign currency held by a country's central bank change with nonzero values of its official settlements balance. Central banks use their foreign currency reserves to influence exchange rates. A depletion of foreign reserves may limit the central bank's ability to influence or peg the exchange rate. For some countries (particularly developing countries), central-bank reserves may be important as a way of allowing the economy to maintain consumption or investment when foreign borrowing is difficult. A high level of reserves may also perform a signaling role by convincing potential foreign lenders that the country is credit-worthy. The balance of payments of a reserve-currency center (such as the United States under the Bretton Woods system) raises special issues best postponed until Chapter 18.7. The official settlements balance, also called the balance of payments, shows the net changein international reserves held by U.S. government agencies, such as the Federal Reserve and the Treasury, relative to the change in dollar reserves held by foreign government agencies. This account provides a partial picture of the extent of intervention in the foreign exchange market. For example, suppose the Bundesbank purchases dollars and deposits them in its Eurodollar account in a London bank. Although this transaction is a form of intervention, it would not appear in the official settlements balance of the United States.Instead, when the London bank credits this deposit in its account in the United States, this transaction will appear as a private financial flow.8. A country could have a current account deficit and a balance of payments surplus at thesame time if the financial and capital account surpluses exceeded the current account deficit. Recall that the balance of payments surplus equals the current account surplus plus the financial account surplus plus the capital account surplus. If, for example, there is a current account deficit of $100 million, but there are large capital inflows and the capital account surplus is $102 million, then there will be a $2 million balance of payments surplus.This problem can be used as an introduction to intervention (or lack thereof) in the foreign exchange market, a topic taken up in more detail in Chapter 17. The government of the United States did not intervene in any appreciable manner in the foreign exchange markets in the first half of the 1980s. The “textbook” consequence of this is a balance of payments of zero, while the actual figures showed a slight balance of payments surplus between 1982 and 1985. These years were also marked by large current account deficits.Thus, the financial inflows into the United States between 1982 and 1985 exceeded the current account deficits in those years.CHAPTER 13EXCHANGE RA TES AND THE FOREIGN EXCHANGE MARKET: AN ASSET APPROACH ANSWERS TO TEXTBOOK PROBLEMS1. At an exchange rate of $1.50 per euro, the price of a bratwurst in terms of hot dogs is 3 hotdogs per bratwurst. After a dollar appreciation to $1.25 per euro, the relative price of a bratwurst falls to 2.5 hot dogs per bratwurst.2. The Norwegian krone/Swiss franc cross rate must be 6 Norwegian krone per Swiss franc.3. The dollar rates of return are as follows:a. ($250,000 - $200,000)/$200,000 = 0.25.b. ($216 - $180)/$180 = 0.20.c. There are two parts of this return. One is the loss involved due to the appreciation of thedollar; the dollar appreciation is ($1.38 - $1.50)/$1.50 = -0.08. The other part of the return is the interest paid by the London bank on the deposit, 10 percent. (The size of the deposit is immaterial to the calculation of the rate of return.) In terms of dollars, the realized return on the London deposit is thus 2 percent per year.4. Note here that the ordering of the returns of the three assets is the same whether wecalculate real or nominal returns.a. The real return on the house would be 25% - 10% = 15%. This return could also becalculated by first finding the portion of the $50,000 nominal increase in the house's price due to inflation ($20,000), then finding the portion of the nominal increase due to real appreciation ($30,000), and finally finding the appropriate real rate of return ($30,000/$200,000 = 0.15).b. Again, subtracting the inflation rate from the nominal return we get 20%- 10% = 10%.c. 2% - 10% = -8%.5. The current equilibrium exchange rate must equal its expected future level since, withequality of nominal interest rates, there can be no expected increase or decrease in the dollar/pound exchange rate in equilibrium. If the expected exchange rate remains at $1.52 per pound and the pound interest rate rises to 10 percent, then interest parity is satisfied only if the current exchange rate changes such that there is an expected appreciation of the dollar equal to 5 percent. This will occur when the exchange rate rises to $1.60 per pound(a depreciation of the dollar against the pound).6. If market traders learn that the dollar interest rate will soon fall, they also revise upwardtheir expectation of the dollar's future depreciation in the foreign-exchange market. Given the current exchange rate and interest rates, there is thus a rise in the expected dollar return on euro deposits. The downward-sloping curve in the diagram below shifts to the right and there is an immediate dollar depreciation, as shown in the figure below where a shift in the interest-parity curve from II to I'I' leads to a depreciation of the dollar from E0 to E1.E($/euro i E 0 E 1Figure 13-27. The analysis will be parallel to that in the text. As shown in the accompanying diagrams, amovement down the vertical axis in the new graph, however, is interpreted as a euro appreciation and dollar depreciation rather than the reverse. Also, the horizontal axis now measures the euro interest rate. Figure 13-3 demonstrates that, given the expected future exchange rate, a rise in the euro interest rate from R 0 to R 1 will lead to a euro appreciation from E 0 to E 1.Figure 13-4 shows that, given the euro interest rate of i, the expectation of a stronger euroin the future leads to a leftward shift of the downward-sloping curve from II to I'I' and a euro appreciation (dollar depreciation) from E to E'. A rise in the dollar interest rate causes the same curve to shift rightward, so the euro depreciates against the dollar. This simply reverses the movement in figure 13-4, with a shift from I'I' to II, and a depreciation of the euro from E' to E. All of these results are the same as in the text when using the diagram for the dollar rather than the euro.EE 0rates o f return (in euro s) (euro E 101Figure 13-3Ei E(euro/$)E ’Figure 13-48. a. If the Federal Reserve pushed interest rates down, with an unchanged expected futureexchange rate, the dollar would depreciate (note that the article uses the term "downward pressure" to mean pressure for the dollar to depreciate). In terms of the analysis developed in this chapter, a move by the Federal Reserve to lower interest rates would be reflected in a movement from R to R' in figure 13.5, and a depreciation of the exchange rate from E to E'.If there is a "soft landing", and the Federal Reserve does not lower interest rates, then thisdollar depreciation will not occur. Even if the Federal Reserve does lower interest rates a little, say from R to R", this may be a smaller decrease then what people initially believed would occur. In this case, the expected future value of the exchange rate will be more appreciated than before, causing the interest-parity curve to shift in from II to I'I' (as shown in figure 13.6). The shift in the curve reflects the "optimism sparked by the expectation of a soft landing" and this change in expectations means that, with a fall in interest rates from R to R", the exchange rate depreciates from E to E", rather than from E to E *, which would occur in the absence of a change in expectations.ER ’ EE*Rrates of return (in dollars)Figure 13-5EE Rrates of return (in dollars) E ”E *R ”Figure 13-6b. The "disruptive" effects of a recession make dollar holdings more risky. Risky assets mustoffer some extra compensation such that people willingly hold them as opposed to other, less risky assets. This extra compensation may be in the form of a bigger expected appreciation of the currency in which the asset is held. Given the expected future value of the exchange rate, a bigger expected appreciation is obtained by a more depreciated exchange rate today. Thus, a recession that is disruptive and makes dollar assets more risky will cause a depreciation of the dollar.9. The euro is less risky for you. When the rest of your wealth falls, the euro tends toappreciate, cushioning your losses by giving you a relatively high payoff in terms of dollars. Losses on your euro assets, on the other hand, tend to occur when they are leastpainful, that is, when the rest of your wealth is unexpectedly high. Holding the euro therefore reduces the variability of your total wealth.10. The chapter states that most foreign-exchange transactions between banks (which accountsfor the vast majority of foreign-exchange transactions) involve exchanges of foreign currencies for U.S. dollars, even when the ultimate transaction involves the sale of one nondollar currency for another nondollar currency . This central role of the dollar makes it a vehicle currency in international transactions. The reason the dollar serves as a vehicle currency is that it is the most liquid of currencies since it is easy to find people willing to trade foreign currencies for dollars. The greater liquidity of the dollar as compared to, say , the Mexican peso, means that people are more willing to hold the dollar than the peso, and thus, dollar deposits can offer a lower interest rate, for any expected rate of depreciation against a third currency, than peso deposits for the same rate of depreciation against that third currency. As the world capital market becomes increasingly integrated, the liquidity advantages of holding dollar deposits as opposed to yen deposits will probably diminish. The euro represents an economy as large as the United States, so it is possible that it will assume some of that vehicle role of the dollar, reducing the liquidity advantages to as far as zero. Since the euro has no history as a currency, though, some investors may be leary of holding it until it has established a track record. Thus, the advantage may fade slowly.11. Greater fluctuations in the dollar interest rate lead directly to greater fluctuations in theexchange rate using the model described here. The movements in the interest rate can be investigated by shifting the vertical interest rate curve. As shown in figure 13.7, these movements lead directly to movements in the exchange rate. For example, an increase in the interest rate from i to i' leads to a dollar appreciation from E to E'. A decrease in the interest rate from i to i" leads to a dollar depreciation from E to E". This diagram demonstrates the direct link between interest rate volatility and exchange rate volatility, given that the expected future exchange rate does not change.EE($/foreign currency)rates of return (in dollars)iE ’i"i'E ”Figure 13-712. A tax on interest earnings and capital gains leaves the interest parity condition the same,since all its components are multiplied by one less the tax rate to obtain after-tax returns. If capital gains are untaxed, the expected depreciation term in the interest parity condition must be divided by 1 less the tax rate. The component of the foreign return due to capital gains is now valued more highly than interest payments because it is untaxed.13. The forward premium can be calculated as described in the appendix. In this case, we findthe forward premium on euro to be (1.26 – 1.20)/1.20 = 0.05. The interest-rate difference between one-year dollar deposits and one-year euro deposits will be 5 percent because the interest difference must equal the forward premium on euro against dollars when covered interest parity holds.CHAPTER 14MONEY, INTEREST RA TES, AND EXCHANGE RA TESANSWERS TO TEXTBOOK PROBLEMS1. A reduction in real money demand has the same effects as an increase in the nominalmoney supply. In figure 14.1, the reduction in money demand is depicted as a backward shift in the money demand schedule from L1to L2. The immediate effect of this is a depreciation of the exchange rate from E1to E2, if the reduction in money demand is temporary, or a depreciation to E3 if the reduction is permanent. The larger impact effect ofa permanent reduction in money demand arises because this change also affects the futureexchange rate expected in the foreign exchange market. In the long run, the price level rises to bring the real money supply into line with real money demand, leaving all relative prices, output, and the nominal interest rate the same and depreciating the domestic currency in proportion to the fall in real money demand. The long-run level of real balances is (M/P2), a level where the interest rate in the long-run equals its initial value.The dynamics of adjustment to a permanent reduction in money demand are from the initial point 1 in the diagram, where the exchange rate is E1, immediately to point 2, where the exchange rate is E3and then, as the price level falls over time, to the new long-run position at point 3, with an exchange rate of E4.2. A fall in a country's population would reduce money demand, all else equal, since asmaller population would undertake fewer transactions and thus demand less money. This effect would probably be more pronounced if the fall in the population were due to a fall in the number of households rather than a fall in the average size of a household since a fall in the average size of households implies a population decline due to fewer children who have a relatively small transactions demand for money compared to adults. The effect on the aggregate money demand function depends upon no change in income commensurate with the change in population -- else, the change in income would serve as a proxy for the change in population with no effect on the aggregate money demand function.R(M /P E 1E 4E 2E 3E(M /PFigure 14-13. Equation 14-4 is M s /P = L(R,Y). The velocity of money, V = Y/(M/P). Thus, when there isequilibrium in the money market such that money demand equals money supply, V = Y/L(R,Y). When R increases, L(R,Y) falls and thus velocity rises. When Y increases, L(R,Y) rises by a smaller amount (since the elasticity of aggregate money demand with respect to real output is less than one) and the fraction Y/L(R,Y) rises. Thus, velocity rises with either an increase in the interest rate or an increase in income. Since an increase in interest rates as well as an increase in income cause the exchange rate to appreciate, an increase in velocity is associated with an appreciation of the exchange rate.4. An increase in domestic real GNP increases the demand for money at any nominal interestrate. This is reflected in figure 14-2 as an outward shift in the money demand function from L 1 to L 2. The effect of this is to raise domestic interest rates from R 1 to R 2 and to cause an appreciation of the domestic currency from E 1 to E 2.5. Just as money simplifies economic calculations within a country, use of a vehicle currencyfor international transactions reduces calculation costs. More importantly, the more currencies used in trade, the closer the trade becomes to barter, since someone who receives payment in a currency she does not need must then sell it for a currency she needs. This process is much less costly when there is a ready market in which any nonvehicle currency can be traded against the vehicle currency, which then fulfills the role of a generally accepted medium of exchange.RE(M M E 1E 2Figure 14-26. Currency reforms are often instituted in conjunction with other policies which attempt tobring down the rate of inflation. There may be a psychological effect of introducing a new currency at the moment of an economic policy regime change, an effect that allows governments to begin with a "clean slate" and makes people reconsider their expectations concerning inflation. Experience shows, however, that such psychological effects cannot make a stabilization plan succeed if it is not backed up by concrete policies to reduce monetary growth.7. The interest rate at the beginning and at the end of this experiment are equal. The ratio ofmoney to prices (the level of real balances) must be higher when full employment is restored than in the initial state where there is unemployment: the money-market equilibrium condition can be satisfied only with a higher level of real balances if GNP is higher. Thus, the price level rises, but by less than twice its original level. If the interest rate were initially below its long-run level, the final result will be one with higher GNP and higher interest rates. Here, the final level of real balances may be higher or lower than the initial level, and we cannot unambiguously state whether the price level has more than doubled, less than doubled, or exactly doubled.8. The 1984 - 1985 money supply growth rate was 12.4 percent in the United States(100%*(641.0 - 570.3)/570.3) and 334.8 percent in Brazil (100%*(106.1 - 24.4)/24.4). The inflation rate in the United States during this period was 3.5 percent and in Brazil the inflation rate was 222.6 percent. The change in real money balances in the United States was approximately 12.4% - 3.5% = 8.9%, while the change in real money balances in Brazil was approximately 334.8% - 222.6% = 112.2%. The small change in the U.S. price level relative to the change in its money supply as compared to Brazil may be due togreater short-run price stickiness in the United States; the change in the price level in the United States represents 28 percent of the change in the money supply ((3.5/12.4)*100%) while in Brazil this figure is 66 percent ((222.6/334.8) *100%). There are, however, large differences between the money supply growth and the growth of the price level in both countries, which casts doubt on the hypothesis of money neutrality in the short run for both countries.9. V elocity is defined as real income divided by real balances or, equivalently, nominalincome divided by nominal money balances (V=P*Y/M). V elocity in Brazil in 1985 was 13.4 (1418/106.1) while velocity in the United States was 6.3 (4010/641). These differences in velocity reflected the different costs of holding cruzados compared to holding dollars. These different costs were due to the high inflation rate in Brazil which quickly eroded the value of idle cruzados, while the relatively low inflation rate in the United States had a much less deleterious effect on the value of dollars.RE(M 1E 3E 2E 1(M 2E 4Figure 14-310. If an increase in the money supply raises real output in the short run, then the fall in theinterest rate will be reduced by an outward shift of the money demand curve caused by the temporarily higher transactions demand for money. In figure 14-3, the increase in the money supply line from (M 1/P) to (M 2/P) is coupled with a shift out in the money demand schedule from L 1 to L 2. The interest rate falls from its initial value of R 1 to R 2, rather than to the lower level R 3, because of the increase in output and the resulting outward shift in the money demand schedule. Because the interest rate does not fall as much when output rises, the exchange rate depreciates by less: from its initial value of E 1 to E 2, rather than to E 3, in the diagram. In both cases we see the exchange rate appreciate back some to E4 in the long run. The difference is the overshoot is much smaller if there is a temporaryincrease in Y. Note, the fact that the increase in Y is temporary means that we still move to the same IP curve, as LR prices will still shift the same amount when Y returns to normal and we still have the same size M increase in both cases. A permanent increase in Y would involve a smaller expected price increase and a smaller shift in the IP curve.Undershooting occurs if the new short-run exchange rate is initially below its new long-run level. This happens only if the interest rate rises when the money supply rises – that is if GDP goes up so much that R does not fall, but increases. This is unlikely because the reason we tend to think that an increase in M may boost output is because of the effect of lowering interest rat es, so we generally don’t think that the Y response can be so great as to increase R.CHAPTER 15PRICE LEVELS AND THE EXCHANGE RA TE IN THE LONG RUNANSWERS TO TEXTBOOK PROBLEMS1. Relative PPP predicts that inflation differentials are matched by changes in the exchangerate. Under relative PPP, the franc/ruble exchange rate would fall by 95 percent with inflation rates of 100 percent in Russia and 5 percent in Switzerland.2. A real currency appreciation may result from an increase in the demand for nontradedgoods relative to tradables which would cause an appreciation of the exchange rate since the increase in the demand for nontradables raises their price, raising the domestic price level and causing the currency to appreciate. In this case exporters are indeed hurt, as one can see by adapting the analysis in Chapter 3. Real currency appreciation may occur for different reasons, however, with different implications for exporters' incomes. A shift in foreign demand in favor of domestic exports will both appreciate the domestic currency in real terms and benefit exporters. Similarly, productivity growth in exports is likely to benefit exporters while causing a real currency appreciation. If we consider a ceterus paribus increase in the real exchange rate, this is typically bad for exporters as their exports are now more expensive to foreigners which may reduce foreign export demand. In general, though, we need to know why the real exchange rate changed to interpret the impact of the change.3. a. A tilt of spending towards nontraded products causes the real exchange rate to appreciateas the price of nontraded goods relative to traded goods rises (the real exchange rate can be expressed as the price of tradables to the price of nontradables).b. A shift in foreign demand towards domestic exports causes an excess demand for thedomestic country's goods which causes the relative price of these goods to rise; that is, it causes the real exchange rate of the domestic country to appreciate.4. Relative PPP implies that the pound/dollar exchange rate should be adjusted to offset theinflation difference between the United States and Britain during the war. Thus, a central banker might compare the consumer price indices in the United States and the U.K. before and after the war. If America's price level had risen by 10 percent while that in Britain had。

2022 年浙江大学远程教育学院《国际金融学》作业(必做)参考答案一、国际收支:指一个国家或者地域在一按时期内(普通为 1 年)在居民与非居民进行的全数国际经济交易中的货币价值。

二、自主性交易:指个人或者企业为某种自主性目的(比如追赶利润、追求市场、旅游、汇款资助亲友等)而主动进行的交易。

3、蒙代尔分派法则:当国内宏观经济和国际收支都趋于不平衡状态时,分派给财政政策以稳定国内经济的任务、分配给货币政策以稳定国际收支的任务。

4、特殊提款权:又称“纸黄金”,是由 IMF 按成员国基金份额无偿分派分配的一种账面资产,可用于会员国政府之间支付国际收支逆差和归还基金组织贷款的资产。

五、 IMF 储蓄头寸:亦称普通提款权,它是指会员国在 IMF 的普通账户中可自由提取和利用的资产。

六、直接标价法:又称对付标价法,系指以固定数额的外国货币为标准折算为若干数额的本国货币表示的汇率。

目前世界绝大部份国家采用这种标价法,惟独英镑、美元等少数例外。

7、铸币平价:以两种金属铸币的含金量之比取得的汇价,被称为铸币平价。

在金本位制度下,汇率决定的基础是铸币平价。

八、外汇:是指一国拥有的可兑换外币或者以可兑换外币计价的并被各国普遍接受、可用于国际债权债务清算的一切资产。

九、货币替代:指在一国经济发展进程中,居民因对本币币值的稳定失去信心或者本国货币资产收益率相对较低时发生的大规模地用本币兑换外汇,从而使外汇在价值贮藏、交易媒介、计价标准等货币职能上全面或者部份地替代本币的一种现象。

10、即期外汇交易:也称现汇交易,是指生意两边在外汇生意成交后,原则上在两个营业日内办理交割的外汇交易方式。

11、远期外汇交易:指外汇生意两边事前签定外汇生意合约,那时并非实际进行支付,而是到了规定的交割日,才按合约规定的币种、数量、汇率办理货币交割的外汇交易方式。

1 二、外汇掉期:指在买进或者卖出即期外汇的同时,卖出或者买时远期外汇,两笔外汇生意货币数额相同,生意方向相反,交割日不同。

10金融危机与金融危机的防范

综合练习题

一、多项选择题

*1、金融危机的传播效应包括(ABD )

A.季风效应

B.溢出效应

C.净传染效应

D.羊群效应

E.接触效应

2、金融危机国际传染中的实体经济路径包括(AD )

A.竞争对手型传染

B.金融机构型传染

C.投资者信心传染

D.贸易伙伴型传染

E.资本市场型传染

二、名词解释

1、金融危机: 是指一个国家或几个国家与地区的全部或大部分金融指标(如:短期利率、货币资产、证券、房地产、土地价格、商业破产数和金融机构倒闭数)的急剧、短暂和超周期的恶化。

2、货币危机: 货币危机概念有狭义、广义之分。

狭义的货币危机与特定的汇率制度(通常是固定货币危机汇率制)相对应,其含义是,实行固定汇率制的国家,在非常被动的情况下(如在经济基本面恶化的情况下,或者在遭遇强大的投机攻击情况下),对本国的汇率制度进行调整,转而实行浮动汇率制,而由市场决定的汇率水平远远高于原先所刻意维护的水平(即官方汇率),这种汇率变动的影响难以控制、难以容忍,这一现象就是货币危机。

广义的货币危机泛指汇率的变动幅度超出了一国可承受的范围这一现象。

3、银行危机: 银行危机是指银行过度涉足(或贷款给企业)从事高风险行业(如房地产、股票),从而导致资产负债严重失衡,呆账负担过重而使资本运营呆滞而破产倒闭的危机。

4、外债危机: 是指在国际借贷领域中大量负债,超过了借款者自身的清偿能力,造成无力还债或必须延期还债的现象。

三、简答题

1、请分析金融危机的传播效应。

答:从经济学和管理学的角度来看,危机给中国传媒业带来三大效应。

“蝴蝶效应”着眼于对立足点的定位,“乘数效应”强调了效果的放大,而“牛鞭效应”预示了传导过程中的变异。

2、20世纪80年代国际债务危机产生的原因是什么?如何解决?

答:导致债务危机的原因

80年代债务危机爆发的原因十分复杂。

归纳起来看,主要有以下6点原因:

①1973~1974年和1979~1980年两次石油提价导致许多国家国际收支出现创纪录的逆差,同时发展中国家中的一些产油国则出现巨额顺差。

②这些顺差大部分被存入银行用于贷款,或者资金回流。

③受70年代后半期负数实际利率的刺激和被商业信贷人的热情所鼓舞,发展中国家掀起了一股借款热潮。

④许多债务国把借入的资金用于(或错误地用于)扩大消费,或投入那些低收益率的项目中(特别是第一次石油危机爆发之后)。

⑤借款国贸易条件恶化的情况几乎贯穿于整个80年代。

⑥为了消除70年代普遍严重的通货膨胀状况,发达工业国家采取了放慢经济增长、大幅度提高利率等财政政策和金融政策,这使债务国的出口机会大大减少,从而进一步削弱了债务国的还债能力。

这次债务危机有内外两方面的原因。

从各发展中国家内部因素看,20世纪60年代以后,广大发展中国家大力发展民族经济,为了加快增长速度,迅速改变落后面貌,举借了大量外债。

但由于各方面的原因,借入的外债未能迅速促进国内经济的发展,高投入,低效益,造成了还本付息的困难。

从外部因素看,导致债务危机的原因包括:①国际经济环境不利。

80年代初世界性经济萧条,是引发债务危机的一个原因。

②70年代后期,国际金融市场的形势对发展中国家不利。

国际信贷紧缩、对发展中国家贷款中私人商业贷款过多,也导致80年代的债务危机。

③美国80年代初实行的高利率,加重了发展中国家的债务负担。

债务危机的爆发对发展中国家和发达国家都有影响。

对此,国际金融机构联合有关国家政府和债权方银行进行了多次对发展中国家债务的重新安排,达成了一些延期支付协议,使危机有所缓和。

广大发展中国家也对国内经济政策进行了调整,并加强了相互间的联合与协调,使危机得到进一步缓和。

3、金融危机爆发的原因及危害是什么?

答:1.美国“低储蓄、高消费”模式是这场金融危机的关键原因

2.金融衍生品泛滥是导致这场金融危机的另一重要原因

3.政府对金融机构的失察也有不可推卸的责任

长期以来,美国奉行自由市场经济,过于相信市场的自我约束和自我调节能力。

在尽量减少政府对经济社会干预为主要经济政策目标的新自由主义思潮的影响下,片面强调市场机制的功能和作用,轻视国家干预在经济和社会发展进程中的重要性,也是导致这场金融危机的重要原因之一。

二、这次金融危机带来的影响和危害

首先,在美国金融危机爆发后,大量金融机构遭受巨额损失,股价惨跌,直接对股市大盘造成冲击。

其次,国际主要金融市场动荡加剧。

再次,这场金融危机已从金融领域扩散到实体经济领域。

因此,已有学者将这次金融危机与上个世纪30年代的“大萧条”相提并论。

4、如何进行金融危机管理?

答:金融危机管理主要是指政府在金融危机的产生、发展过程中,为减少、消除危机的危害,根据金融危机管理预案和程序而直接采取的对策。

从维护金融安全和社会秩序的角度来看,金融危机管理是一种最典型的公共产品,从维持金融秩序的能力视角,金融危机管理是政府必须及时地提供的公共产品。

在我国,应当建立以央行首脑为金融危机管理最高指挥官的常态金融危机管理体系,设立“全国金融危机管理指挥部”,统管全国的金融危机处置。

央行各级分支机构也要设立负责金融

危机管理的部门,应对突然爆发的金融危机。

金融危机不仅会给社会造成巨大的损失,而且对人们的心理会造成巨大的冲击。

纵观当前我国股票市场和房地产金融市场的运行情况,与越南爆发金融危机前的表现有些类似。

于是,人们普遍担心,我国的股市和房市这些资产市场会不会出现崩盘,金融危机是不是已经到来,如何去进行识别并加强防范。

这些都属于金融危机管理的范畴,从目前我国的情况看,加强金融危机管理刻不容缓。

5、金融危机国际传染路径有哪些?

答:(一)实体经济路径

实体经济传染是指通过实体经济关联而达成的危机在国家间的传导和扩散。

其具体形式有: 1.贸易伙伴型传染。

2.竞争对手型传染。

(二)金融路径

金融路径传染是指一个国家因宏观经济波动导致金融机构或金融市场缺乏流动性,进而导致另一个与其有着密切金融联系国家的金融机构或金融市场缺乏流动性,从而导致该国爆发危机。

或者虽然另一个国家与其没有密切联系,但基于预期而导致该国爆发危机。

1.金融机构渠道。

2.资本市场渠道。