小企业管理英文版

- 格式:ppt

- 大小:1.80 MB

- 文档页数:32

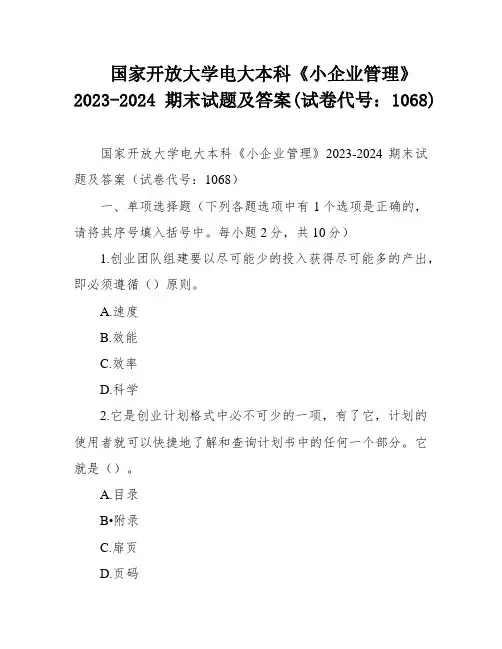

国家开放大学电大本科《小企业管理》2023-2024期末试题及答案(试卷代号:1068)国家开放大学电大本科《小企业管理》2023-2024期末试题及答案(试卷代号:1068)一、单项选择题(下列各题选项中有1个选项是正确的,请将其序号填入括号中。

每小题2分,共10分)1.创业团队组建要以尽可能少的投入获得尽可能多的产出,即必须遵循()原则。

A.速度B.效能C.效率D.科学2.它是创业计划格式中必不可少的一项,有了它,计划的使用者就可以快捷地了解和查询计划书中的任何一个部分。

它就是()。

A.目录B•附录C.扉页D.页码3.下列属于权益融资方式的有()。

A.商业用B.银行借贷C.资产抵押D.企业上市4.小企业在保证质量的前提下,在设计和生产过程中注意原材料的节约使用,从而降低成本获取竞争优势,这就是()的低成本战略。

A.简化产品B.节约原材料C.降低管理费用D.实行生产创新5.在以下营销组合因素中,能够直接产生收入的途径是()。

A.分销渠道B.广告C.销售促进D.定价二、多项选择题(下列各题选项中有2-5个是正确的,请将这些序号填入括号中。

每小题2分,共10分)6.根据我国《中小企业划型标准规定》,中小企业可以划为中型、小型、微型三种,具体划分标准是根据()等指标,并结合行业特点制定。

A.从业人员B.净利润率C.营业收入D.资产总额E.注册资金总额7.组建创业团队要考虑的关键问题是()。

A.团队的物质资源B.团队的财务资源C.团队的异质性D.团队的完整性E.团队的友谊8.创业设计的内容包括()oA.人员选择C.地址选择D.工程选择E.组织结构9.创建新企业的必备条件有()等。

A.拥有专利手艺B.拥有事情经验C.拥有合伙人D.拥有一定量的客户群E.获得充足的创业资金10.小企业运营系统设计的主要内容包括()A.质量管理B.设施选址和布置C.供应链管理oD.产品和服务设计E.生产计划和事情设计三、判断正误题(下列各题有对有错,对的打错的打X。

企业管理英文作文范文英文:As a business manager, I believe that effective communication and delegation are key to successful management. It is important to clearly communicate goals and expectations to your team, and to delegate tasks based on each individual's strengths and abilities.When it comes to communication, I find that being direct and transparent is the best approach. This means being honest about challenges and setbacks, as well as celebrating successes. It's also important to actively listen to your team and address any concerns or feedback they may have.In terms of delegation, it's important to trust your team members and give them the autonomy to complete tasks in their own way. This not only empowers them, but also frees up your time to focus on other important aspects ofthe business.One example of effective delegation in my experiencewas when I assigned a project to a team member who had a strong background in marketing. I provided clear guidelines and expectations, but also gave them the freedom to come up with their own ideas and strategies. The project was a success and the team member felt valued and appreciated for their contributions.Overall, effective communication and delegation are crucial for successful business management. By being direct, transparent, and trusting your team, you can create a positive and productive work environment.中文:作为企业管理者,我认为有效的沟通和委派是成功管理的关键。

本科毕业设计(论文)中英文对照翻译(此文档为word格式,下载后您可任意修改编辑!)作者:Bernard G期刊:International Journal of Information Business and Management 第5卷,第3期,pp:41-51.原文The research of financial Risk Management in SMESBernard GINTRUDUCTIONSmall and medium sized enterprises (SME) differ from large corporations among other aspects first of all in their size. Theirimportance in the economy however is large . SME sector of India is considered as the backbone of economy contributing to 45% of the industrial output, 40% of India’s exports, employing 60 million people, create 1.3 million jobs every year and produce more than 8000 quality products for the Indian and international markets. With approximately 30 million SMEs in India, 12 million people expected to join the workforce in next 3 years and the sector growing at a rate of 8% per year, Government of India is taking different measures so as to increase their competitiveness in the international market. There are several factors that have contributed towards the growth of Indian SMEs. Few of these include; funding of SMEs by local and foreign investors, the new technology that is used in the market is assisting SMEs add considerable value to their business, various trade directories and trade portals help facilitate trade between buyer and supplier and thus reducing the barrier to trade With this huge potential, backed up by strong government support; Indian SMEs continue to post their growth stories. Despite of this strong growth, there is huge potential amongst Indian SMEs that still remains untapped. Once this untapped potential becomes the source for growth of these units, there would be no stopping to India posting a GDP higher than that of US and China and becoming the world’s economic powerhouse. RESEARCH QUESTIONRisk and economic activity are inseparable. Every business decisionand entrepreneurial act is connected with risk. This applies also to business of small and medium sized enterprises as they are also facing several and often the same risks as bigger companies. In a real business environment with market imperfections they need to manage those risks in order to secure their business continuity and add additional value by avoiding or reducing transaction costs and cost of financial distress or bankruptcy. However, risk management is a challenge for most SME. In contrast to larger companies they often lack the necessary resources, with regard to manpower, databases and specialty of knowledge to perform a standardized and structured risk management. The result is that many smaller companies do not perform sufficient analysis to identify their risk. This aspect is exacerbated due to a lack in literature about methods for risk management in SME, as stated by Henschel: The two challenging aspects with regard to risk management in SME are therefore: 1. SME differ from large corporations in many characteristics 2. The existing research lacks a focus on risk management in SME The following research question will be central to this work: 1.how can SME manage their internal financial risk? 2.Which aspects, based on their characteristics, have to be taken into account for this? 3.Which mean fulfils the requirements and can be applied to SME? LITERA TURE REVIEWIn contrast to larger corporations, in SME one of the owners is oftenpart of the management team. His intuition and experience are important for managing the company. Therefore, in small companies, the (owner-) manager is often responsible for many different tasks and important decisions. Most SME do not have the necessary resources to employ specialists on every position in the company. They focus on their core business and have generalists for the administrative functions. Behr and Guttler find that SME on average have equity ratios lower than 20%. The different characteristics of management, position on procurement and capital markets and the legal framework need to be taken into account when applying management instruments like risk management. Therefore the risk management techniques of larger corporations cannot easily be applied to SME. In practice it can therefore be observed that although SME are not facing less risks and uncertainties than large companies, their risk management differs from the practices in larger companies. The latter have the resources to employ a risk manager and a professional, structured and standardized risk management system. In contrast to that, risk management in SME differs in the degree of implementation and the techniques applied. Jonen & Simgen-Weber With regard to firm size and the use of risk management. Beyer, Hachmeister & Lampenius observe in a study from 2010 that increasing firm size among SME enhances the use of risk management. This observation matches with the opinion of nearly 10% of SME, which are of the opinion, that risk management is onlyreasonable in larger corporations. Beyer, Hachmeister & Lampenius find that most of the surveyed SME identify risks with help of statistics, checklists, creativity and scenario analyses. reveals similar findings and state that most companies rely on key figure systems for identifying and evaluating the urgency of business risks. That small firms face higher costs of hedging than larger corporations. This fact is reducing the benefits from hedging and therefore he advises to evaluate the usage of hedging for each firm individually. The lacking expertise to decide about hedges in SME is also identified by Eckbo, According to his findings, smaller companies often lack the understanding and management capacities needed to use those instruments. METHODOLOGY USE OF FINANCIAL ANAL YSIS IN SME RISK MANAGEMENT How financial analysis can be used in SME risk management? Development of financial risk overview for SME The following sections show the development of the financial risk overview. After presenting the framework, the different ratios will be discussed to finally present a selection of suitable ratios and choose appropriate comparison data. Framework for financial risk overviewThe idea is to use a set of ratios in an overview as the basis for the financial risk management.This provides even more information than the analysis of historicaldata and allows reacting fast on critical developments and managing the identified risks. However not only the internal data can be used for the risk management. In addition to that also the information available in the papers can be used. Some of them state average values for the defaulted or bankrupt companies one year prior bankruptcy -and few papers also for a longer time horizon. Those values can be used as a comparison value to evaluate the risk situation of the company. For this an appropriate set of ratios has to be chosen. The ratios, which will be included in the overview and analysis sheet, should fulfill two main requirements. First of all they should match the main financial risks of the company in order to deliver significant information and not miss an important risk factor. Secondly the ratios need to be relevant in two different ways. On the one hand they should be applicable independently of other ratios. This means that they also deliver useful information when not used in a regression, as it is applied in many of the papers. On the other hand to be appropriate to use them, the ratios need to show a different development for healthy companies than for those under financial distress. The difference between the values of the two groups should be large enough to see into which the observed company belongs. Evaluation of ratios for financial risk overview When choosing ratios from the different categories, it needs to be evaluated which ones are the most appropriate ones. For this some comparison values are needed inorder to see whether the ratios show different values and developments for the two groups of companies. The most convenient source for the comparison values are the research papers as their values are based on large samples of annual reports and by providing average values outweigh outliers in the data. Altman shows a table with the values for 8 different ratios for the five years prior bankruptcy of which he uses 5, while Porporato & Sandin use 13 ratios in their model and Ohlson bases his evaluation on 9 figures and ratios [10]. Khong, Ong & Y ap and Cerovac & Ivicic also show the difference in ratios between the two groups, however only directly before bankruptcy and not as a development over time [9]. Therefore this information is not as valuable as the others ([4][15]).In summary, the main internal financial risks in a SME should be covered by financial structure, liquidity and profitability ratios, which are the main categories of ratios applied in the research papers.Financial structureA ratio used in many of the papers is the total debt to total assets ratio, analyzing the financial structure of the company. Next to the papers of Altman, Ohlson and Porporato & Sandin also Khong, Ong & Y ap and Cerovac & Ivicic show comparison values for this ratio. Those demonstrate a huge difference in size between the bankrupt andnon-bankrupt groups.Therefore the information of total debt/total assets is more reliable and should rather be used for the overview. The other ratios analyzing the financial structure are only used in one of the papers and except for one the reference data only covers the last year before bankruptcy. Therefore a time trend cannot be detected and their relevance cannot be approved.译文中小企业财务风险管理研究博纳德引言除了其他方面,中小型企业(SME)与大型企业的不同之处首先在于他们的规模不同,但是,他们在国民经济中同样具有重要的作用。

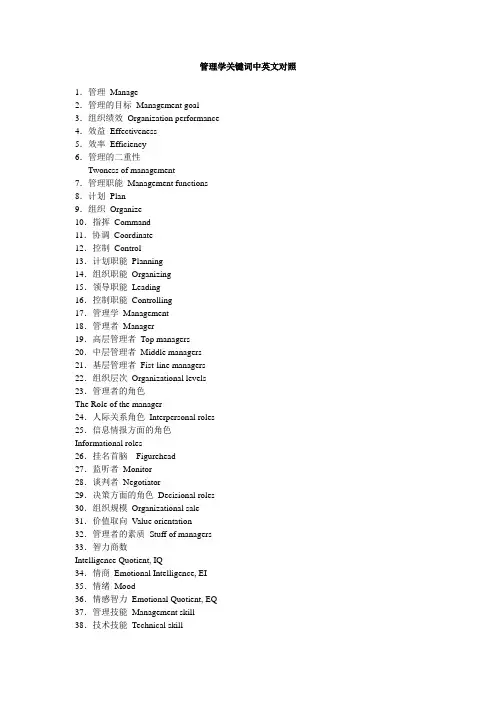

管理学关键词中英文对照1.管理Manage2.管理的目标Management goal3.组织绩效Organization performance4.效益Effectiveness5.效率Efficiency6.管理的二重性Twoness of management7.管理职能Management functions8.计划Plan9.组织Organize10.指挥Command11.协调Coordinate12.控制Control13.计划职能Planning14.组织职能Organizing15.领导职能Leading16.控制职能Controlling17.管理学Management18.管理者Manager19.高层管理者Top managers20.中层管理者Middle managers21.基层管理者Fist-line managers22.组织层次Organizational levels23.管理者的角色The Role of the manager24.人际关系角色Interpersonal roles25.信息情报方面的角色Informational roles26.挂名首脑Figurehead27.监听者Monitor28.谈判者Negotiator29.决策方面的角色Decisional roles30.组织规模Organizational sale31.价值取向Value orientation32.管理者的素质Stuff of managers33.智力商数Intelligence Quotient, IQ34.情商Emotional Intelligence, EI35.情绪Mood36.情感智力Emotional Quotient, EQ37.管理技能Management skill38.技术技能Technical skill39.人际技能Human skill40.概念技能Conceptual skill41.劳动分工Divide of labor42.劳动生产力Prolificacy of work43.劳动时间Time of work44.科学管理理论Scientific management theory 45.工业革命Industrial revolution46.泰罗制Taylor’s Principles47.时间研究Labor time study48.动作研究Motion study49.一般管理理论General administrative theory 50.管理原则Principles of management51.行政组织理论Administrative organization theory 52.古典组织理论Classical organization theory 53.行政管理Administrative management54.官僚制Bureaucracy55.官僚行政组织Bureaucracy56.行为科学Behavior science57.霍桑效应Hawthorne effect58.组织行为Organization behavior59.行为科学理论Behavior school60.X –Y 理论Theory X Y61.X理论Theory X62.Y理论Theory Y63.管理理论丛林Management theory jungle64.管理过程学派Management process school 65.人际关系学派Human relation school66.人际关系Human relation67.群体行为学派Group behavior school68.经验(或案例)学派Experience school69.社会合作系统学派Social technical systems theory 70.社会技术系统学派Social technical systems theory 71.系统管理学派Systems theory school72.决策理论学派Decision theory school 73.管理科学学派Management science school 74.权变理论学派Contingencies theory school 75.权变Contingencies76.经理角色学派Manager role school77.企业文化Organization culture78.愿景Vision79.共同愿景Shared vision80.文化冲击Culture shock81.公司再造Company Reengineering82.准时生产(JIT)Just-in-time83.计算机集成制造系统(CIM)Computer integrated manufacturing 84.精益生产Lean manufacturing85.学习型组织Learning organization86.管理环境Managerial environment87.外部环境External environment88.内部环境Internal environment89.一般环境因素General environmental factors90.宏观环境因素Macro environmental factors91.直接作用因素Direct-action factors92.间接作用因素Indirect-action factors93.环境的复杂性Environmental complexity94.动态环境Dynamic environment95.PEST分析法, PEST(polictial,economic,social,technological) 96.政治与法律环境Political & Legal environment97.特殊任务环境Specific environment98.供应商Suppliers99.服务对象Service object100.顾客Customer101.竞争对手Competitors102.潜在竞争对手Potential competitors103.竞争环境Competitive environment104.竞争意识Competitive intelligence105.进入障碍Barriers to entry106.规模经济Economies of scale107.范围经济Economies of scope108.政府管理部门Government Management department109.特殊利益团体Special-interest groups110.组织内部环境Organizational environment111.组织文化Organizational culture112.使命Mission113.凝聚力Cohesiveness114.合作Collaboration115.核心竞争力Core competence116.环境设计Design for environment117.组织设计Organizational design118.社会责任Social responsibility119.社会义务Social obligation120.社会响应Social responsiveness121.管理道德Management ethics122.道德规范Morality rule123.伦理Ethics124.可持续发展Sustainable development125.全球化Globalization126.全球组织模式Global organization model127.全球性组织Global organization128.全球性外包Global outsourcing129.全球战略Global strategy130.组织利益相关者Stakeholders131.组织Organization132.组织绩效Organizational performance133.生产型组织Manufacture organization134.服务型组织Service organization135.私人组织Private organization136.公共组织Commonality organization137.正式组织Formal organization138.非正式组织Informal organization139.实体组织Entity organization140.虚拟组织Virtual organization141.商业计划Business plan142.企业家Entrepreneur143.企业家才能Entrepreneurship144.创业Entrepreneurship145.创业机会分析Opportunity analysis146.组织目标Organizational goals147.研究与开发(R&D)Research and development 148.目标管理(MBO)Management by objective 149.企业Enterprise150.小企业Small business151.企业法人Corporation152.组织的法律形式Legal forms of organization 153.独资企业Solely- invested enterprise154.个人业主制企业 Sole proprietorship155.合伙制企业Partnership enterprise156.公司制企业Corporation157.有限责任公司Limited liability partnership 158.股份有限公司Limited liability Company 159.无限公司Unlimited company160.两合公司Limited partnership161.企业集团Group company162.劳动密集型企业Labor denseness enterprise 163.资金密集型企业Capital denseness enterprise 164.知识密集型企业Knowledge denseness enterprise 165.股东Shareholder166.董事Director167.董事会Directorate168.监事Monitor169.总经理General manager170.首席执行官(CEO)Chief executive officer171.非营利性组织Nonprofit organitation172.企业生命周期The corporate lifecycles173.发展Development174.萌芽阶段Embryonic stage175.衰退阶段Decline stage176.环境的不确定性Environmental uncertainty 177.组织变革Organization transform178.障碍Obstacle179.核心能力Core competencies180.战略Strategy181.战略管理Strategic management182.战略单位Strategic business units183.企业战略Enterprise strategy184.业务战略Business stratagem185.战略实施Strategy implementation186.差异化Differentiation187.差异化战略Differentiation strategy188.集中战略Concentration strategy189.一体化Intgeration190.纵向一体化V ertical integration191.同业多样化战略Concentric diversification strategy 192.战略联盟Strategic alliance193.合作战略Cooperative strategies194.机会Opportunities195.威胁Threats196.优势Strengths197.劣势Weaknesses198.风险Venture199.SWOT分析SWOT analysis200.成长战略Growth strategies201.稳固战略Stability strategies202.撤退战略Retrenchment strategies203.战略方针Strategic policy204.战略目标Strategic goles205.战略步骤Strategic process206.战略重点Strategic keystone207.战略措施Strategic measure208.预测Forecasting209.长期预测Long-time forecast210.中期预测Metaphase forecast211.短期预测Short-time forecast212.定性预测方法Qualitative forecast213.定量预测方法Quantitative forecast214.德尔菲法Dalphi Method215.讨论Discussion216.集合意见法Jury of opinion217.头脑风暴法Brainstorming218.时间序列法Time series analysis models 219.因果分析法Cause and effect analysis models 220.回归分析预测法Regression modals221.决策Decision222.决策过程Decision –making process 223.问题Problem224.决策标准Decision criteria225.权重Weights226.备选方案Alternatives227.最优化决策Optimum decision228.满意Satisfied229.评价Evaluating230.直觉决策Intuitive decision231.定性决策Qualitative decision232.定量决策Quantitative decision233.战略决策Stratagem decision making234.战术决策Tactics decision235.程序化决策Programmed decision236.非程序化决策Nonprogrammed decision 237.确定型决策Certain decision238.风险型决策Risk decisions239.不确定型决策Uncertain decision240.长期决策Long-term decision241.中期决策Intermediate-term decision242.短期决策Short-term decision243.个人决策Person decision244.集体决策Group decision245.有限理性Bounded rationality246.量本利分析法Breakeven analysis247.盈亏平衡点Breakeven point248.固定成本Fixed costs249.变动成本Variable costs250.决策树Decision tree251.悲观决策法Pessimistic decision252.乐观决策法Optimistic decision253.折衷决策法Compromise decision254.机会均等决策法Occasion equalization decision 255.最小后悔值决策法Regardless decision 256.计划Plan257.执行计划Execute plan258.宗旨Aim259.使命Mission260.目标Goal261.战略Stratagem262.政策Policy263.程序Process264.规则Rule265.规划Program266.项目Project267.预算Budget268.环境扫描Environmental scanning269.长期计划Long-term plans270.中期计划Intermediate-term plans271.短期计划Short-term plans272.战略计划Strategic plans273.业务计划Operational plans274.综合计划Synthetic plans275.局部计划Department plans276.项目计划Project plans277.高层管理计划Top management plans278.中层管理计划Middle management plans279.基层管理计划Fist-line management plans280.生产计划Manufacture281.供应计划Provide plans282.新产品开发计划New product plan283.营销计划Marketing plans284.财务计划Finance plans285.人事计划Human plans286.情境计划Scenario planning287.后勤保障计划Service ensure plans288.指令性计划Mandatory plans289.指导性计划Directional plans290.派生(辅助)计划Derivative plans291.甘特图Gantt chart292.滚动计划方法Rolling plan technique293.网络计划技术Network plan technique294.项目评审法(PERT) Program Evaluation and review techniques 295.线性规划Linear programming296.组织Organizing297.组织结构Organizational structure298.组织工作Organize299.劳动分工Division of labor300.统一指挥Unity of command301.职权Authority302.职责Accountability303.直线权力Line authority304.参谋权力Staff authority305.职能权力Function authority306.组织设计Organizational design307.组织结构设计Organizational structure design 308.组织手册Organization handbook309.职位说明书Job description310.组织系统图Organization system chart 311.组织规模Organization scale312.机械式的结构Mechanistic organization 313.单件生产Unit production314.小量生产Small production315.成批生产Process production316.大量生产Mass production317.连续生产Continuum production318.目标原则Goal principle319.管理幅度Span of control320.指控链Chain of command321.管理层次Chain of command322.岗位设定Job design323.工作分析Job analysis324.岗位设定Job design325.岗位轮换Job rotation326.多样化培训Diversity training327.岗位扩大化Job enlargement328.岗位丰富化Job enrichment329.部门划分Departmentalization330.部门化Departmentalization331.职能部门Functional department332.产品部门化Product departmentalization 333.地区划分部分Geographical departmentalization 334.顾客划分部门Customer departmentalization 335.管理者的能力Ma nager’s ability336.扁平型组织Flattening organization337.锥型组织Awl organization338.组织构架Organizational architecture339.机械式组织Mechanistic organization340.有机式组织Organic organization341.集权Centralization of state power342.集权组织Centralized organization343.分权Decentralization of state power344.分权组织Decentralized organization345.委员会制Committee system346.直线制组织结构Line strcture347.职能制组织结构Functional structure348.直线职能制组织结构Line-functional structure349.事业部制组织机构Divisional structure350.矩陈制组织结构Matrix structure351.专门工作组Bottlegging352.模拟分权制组织Simulation Decentralized organization 353.网络结构Network structure354.领导Leading355.领导Leadership356.职位权力Position power357.个人影响Referent power358.合法权Legitimate authority359.奖赏权Reward power360.惩罚权Punish right361.模范权Exemplary right362.专长权Specialty right363.魅力权Glamour right364.感情权Affection right365.士气Morale366.领导风格Leadership styles367.专制作风Autocratic styles368.民主作风Democratic styles369.放任作风Laissez-faire styles370.领导行为理论Behavioral approach371.管理方格图Managerial grid chart372.贫乏型管理Impoverished management373.任务型管理Task management374.俱乐部型管理Country club management375.中庸型的管理Middle –of –the- road management 376.团队型的管理Team management377.领导权变理论Contingency theory378.菲德勒的权变理论Fiedler contingency model379.“任务导向型”的领导方式Task –oriented leadership 380.“关系导向型”的领导方式Relationship-oriented leadership 381.菲德勒模型The Fiedler model382.情境领导理论Situational leadership theory383.途径——目标理论Path –goal theory384.教练Coach385.指导Coaching386.授权Authorization387.沟通Communicate388.消息Message389.渠道Channel390.传言链Grapevine chains391.语言沟通Verbal communication392.非语言沟通Nonverbal communication393.身体语言Body language394.过滤Filtering395.正式沟通Formal communication396.非正式沟通Informal communication397.小道消息Grapevine398.横向沟通Horizontal communication399.单向沟通One –way communication400.对上沟通Upward communication401.对下沟通Downward communication402.斜向沟通Diagonal communication403.沟通网络Communication network404.链式沟通网络Chain communication network 405.环式沟通网络Round communication network 406.Y式沟通网络Y communication network407.纵向沟通网络Vertical communication network 408.轮式沟通网络Wheel communication network 409.全通道式沟通网络All channel communication network 410.团队管理Team management411.激励Motivation412.激励因素Motivators413.需求Needs414.诱因Inducement415.动机Motivation416.行为Action417.绩效Performance418.激励理论Motivation theory419.内容型激励理论Content motivation theory420.积极性Enthusiasm421.需求层次理论Hierarchy of needs theory422.需求Need423.需求层次Need hierarchy424.生理需要Physiological needs425.安全需要Safety needs426.社交需要Social need427.尊重需要Esteem need428.自我实现需要Self –actualization needs 429.“ERG”理论ERG theory430.存在需要Existence need431.关系需要Relatedness need432.成长需要Growth need433.成就激励论Three-need theory434.成就需要Need for achievement435.权力需要Need for power436.合群需要Need for affiliation437.双因素理论Two –factors theory438.激励——保健理论Motivation –Hygiene theory 439.保健因素Hygiene factors440.激励因素Motivation factors441.满意Satisfaction442.不满意Dissatisfaction443.过程型激励理论Process motivation theory 444.期望Expectancy445.期望理论Expectancy theory446.效价Valence447.努力Make great efforts448.期望Expectation449.公平理论Equity theory450.投入Input451.产出Outcomes452.公平Equity453.不公平Inequity454.外在强化Extrinsic rewards455.内在强化Intrinsic rewards456.强化理论Reinforcement theory457.正强化Positive reinforcement458.负强化Negative reinforcement459.规避性学习Avoidance learning460.修正行为Behavior modification461.搭便车Hitchhike462.投机心理Venture psychology463.消退Fade away464.目标激励法Goal –setting theory465.报酬激励法Reward –setting theory466.工资Wage467.津贴Allowance468.认可Certificate469.赞赏Admiration470.奖惩Rewards and punishment471.惩罚Punishment472.考评Appraise473.控制Control474.控制系统Control system475.信息Information476.反馈Feedback477.信息反馈Information feedback478.控制论Cybernectics479.偏差Warp480.纠正Rectify481.前馈控制Feedforward control482.实时控制Real-time control483.反馈控制Feedback control484.业绩考核Performance appraisals 485.财务报表Financial statement486.资产负债表Balance sheet487.损益表Income statement488.现金流量表Statement of cash flow 489.预算Budgeting490.预算控制Budgeting control491.财务预算Financial budget492.业务预算Operation budget493.销售预算Sell budget494.生产预算Production budget495.生产进度日程表Production schedule table 496.内部审计Internal audit497.外部审计External audit498.创新Innovation499.技术创新Technoiogical innovations 500.产品创新Product innovation501.流程再造Process reengineering502.产品设计Product design503.首席技术官Chief technology officier。

SBU管理模式概念:SBU是Strategical Business Unit的英文缩写,即战略经营单位管理模式,由美国GM公司总裁阿尔弗雷德.P.斯隆在70年代提出。

目的:彻底实现企业内部与市场接轨提高质量、降低成本、增加利润形成利益共同体,真正实现职工与老板的利益完全统一特征:独立经营、独立核算、上下买卖关系等。

为充分调动各方面资源,尽快将装备优势转化为产品优势,提高新产品研发和市场推进的效率,提升综合竞争力,在“产销研”一体化运行机制的基础上推行战略经营单位(SBU)管理,成立八个SBU项目推进组。

一是确定SBU项目推进组组组织结构及职责。

二是做好责任目标任务分解和责任落实工作。

三是制定年度目标责任制和管理办法,扎实推进工作。

四是统一协调,加强管理,做好月度和阶段性总结和汇报。

据悉,国内海尔(98年)、太钢、济钢、邯钢(10年)等多家企业都引入SBU管理体制,在开发品种、开拓市场、提升企业市场竞争力、推动企业实现战略目标方面已经发挥了重要作用。

杨克明助理联系电话010-********邯钢公司召开2010年SBU总结表彰暨2011年SBU启动大会1月5日下午,邯钢公司召开2010年SBU总结表彰暨2011年SBU 启动大会。

公司董事长、党委书记、SBU领导小组组长李贵阳,总经理、副董事长、党委副书记、SBU领导小组组长彭兆丰出席会议并发表重要讲话,要求公司广大干部职工积极投身到快速提升产品结构和品牌形象的事业中,进一步推进SBU工作,尽快将装备优势转变为产品优势和市场竞争优势,提升邯钢核心竞争力。

公司总会计师、SBU领导小组副组长郭景瑞,副总经理、SBU领导小组副组长李广亮,公司总工程师、SBU领导小组常务副组长许斌出席会议。

出席会议的还有公司副总工程师、SBU领导小组副组长唐恒国。

李广亮主持大会。

李贵阳指出,公司自去年6月初正式启动重点战略产品SBU机制以来,在重点产品销售、生产和工艺技术创新等方面均取得了一定成效,SBU管理模式的良好作用初步显现。

SIYB培训项目讲义《创办和改善你的企业》(Start and Improve Your Business 简称SIYB)SIYB培训是国际劳工组织为帮助微小企业发展,促进就业,专门研究开发的一系列培训小企业家的培训课程,它包括四个培训模块:·产生你的企业想法(GYB)·创办你的企业(SYB)·改善你的企业(IYB)·扩大你的企业(EYB)●这套培训课程专门培养潜在的和现有的小企业创办者,使他们有能力创办切实可行的企业,提高现有企业的生命力和盈利能力,并在此过程中为他人创造就业机会.●目前,SIYB培训已经成为国际劳工组织的创业培训品牌,在全球80多个国家使用并取得了很好的效果,受到各国的普遍欢迎。

被成为小MBA。

●我国与2001年引入SYB项目,在全国试点城市取得巨大成功。

2004年7月正式启动SIYB 项目,GYB、SYB、IYB三个培训模块已经成熟,在实践中也缺德了成功;EYB也在逐步引进。

SIYB培训的四个模块《创办你的企业》 START YOUR BUSINESS中国就业形势:压力巨大长期多钟就业压力交织小企业发展阶段创办 巩固扩大企业发展时间城镇就业压力民工进城创业:就业新道创业定义创业是指不受雇一个单位,而是自己开办和经营企业,为自己和他人创造就业机会。

常见几个概念:创业:理性、有计划地创办企业。

闯业:无计划地办企业。

创业成功:三年内还生存的企业。

成功闯业:短时间企业倒闭了。

●“财聚人散,财散人聚”●30%机会+70%人脉资源●公司可以有负债,但不可一日无现金什么是创业培训?创业培训:是面向有志于创办小企业并具有相应素质的劳动者开展的一种特殊的培训形式。

旨在:让培训者掌握自谋职业和自主创办小企业的方法,并以造就小企业的创办者为己任。

第一.创业意识培训:要求培训者具备对市场的把握能力和洞察能力,第二。

创业计划培训:是对培训者进行技术,技能和人员管理方面的培训,并在创业时刻得到劳动部门的支持,获得2万元以内的小额贷款.第三。

erp心得体会范文erp心得体会范文篇1ERp模拟实践结束了,历时一天的时间,我们做了四年的沙盘经营。

各个小组都有不同的体会,但是我想我们这一组,这个“公司”是体会最深的吧。

原本以为我们的“公司”快要破产了,没想到在老师的拯救下我们反败为胜,获得了实践的第一名,这对于我们说无疑是令人感到喜悦的。

刚开始的时候完全不懂ERp这一词的意思,只知道要做这个实验,后老师讲解以后就知道了它的全称是EnterpriseResureplanning也就是企业资计划的意思,对于一个企业说最总要的就是优化资配置,这样才可以最大限度的将盈利和资保护结合起。

时间开始,老师将我们分成了A—F组,我们所在的是F组,每组十个人,分E、E助理、财务总监、财务助理、营销总监、营销助理、生产总监、生产助理、供应总监、供应助理。

我担任的是供应总监这个角色,做为一个供应总监,把握原材料的供应情况是非常总要的。

要注意细节,进货数量。

实践第0年老师领着我们共同经营,让我们了解了一下基本流程,很快0年的经营结束,改换我们自己经营,由于我们经营战略的失误,第一年公司亏欠了两千一百万,这个结果有一点小小的打击到我们,但是这只是刚开始,我们相信我们是可以做到盈利的。

第二年终于给了我们一些安慰,盈亏平衡了。

到了第三年大家的信心越越满,兴趣也越越浓,彼此互相帮助。

可是由于生产部门的计算错误,公司亏欠一千七百万,有订单却交不了货,直接面临破产的威胁,这时大家的信心越越少,大家就直接坐在那儿一动不动,我想这对与我们说真的是一个巨大的困难,可是困难了就要迎难而上,坚持下去。

到最后大家搬了救兵,我们的大大总裁陈老师,大家和她一起想办法,最后想出了再多建一条生产线,这样就可以交订单了。

危机解除,大家的信心又回了,后越做越顺利,到第四年成为了区域龙头老大,最终盈利180,最后获得小组赛的第一名。

这本是一场需要历时两天的战役,没想打在大家的共同合作和努力下,作战提前一天完成,节约了时间又获得了好成绩,这是最令人喜悦的。

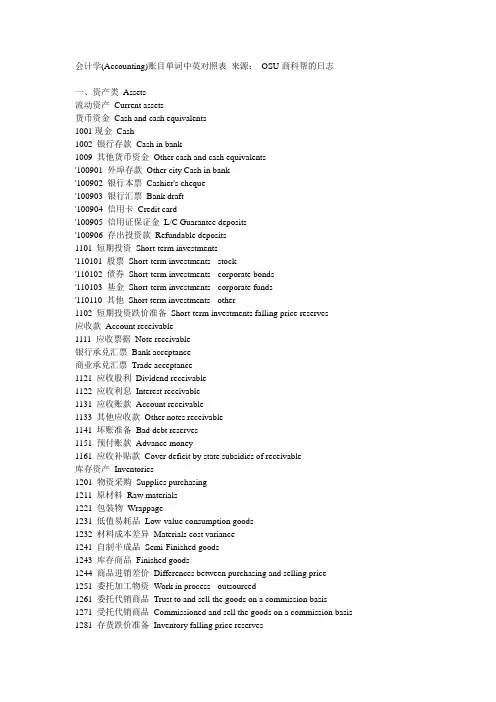

会计学(Accounting)账目单词中英对照表来源:OSU商科帮的日志一、资产类Assets流动资产Current assets货币资金Cash and cash equivalents1001现金Cash1002 银行存款Cash in bank1009 其他货币资金Other cash and cash equivalents'100901 外埠存款Other city Cash in bank'100902 银行本票Cashier's cheque'100903 银行汇票Bank draft'100904 信用卡Credit card'100905 信用证保证金L/C Guarantee deposits'100906 存出投资款Refundable deposits1101 短期投资Short-term investments'110101 股票Short-term investments - stock'110102 债券Short-term investments - corporate bonds'110103 基金Short-term investments - corporate funds'110110 其他Short-term investments - other1102 短期投资跌价准备Short-term investments falling price reserves应收款Account receivable1111 应收票据Note receivable银行承兑汇票Bank acceptance商业承兑汇票Trade acceptance1121 应收股利Dividend receivable1122 应收利息Interest receivable1131 应收账款Account receivable1133 其他应收款Other notes receivable1141 坏账准备Bad debt reserves1151 预付账款Advance money1161 应收补贴款Cover deficit by state subsidies of receivable库存资产Inventories1201 物资采购Supplies purchasing1211 原材料Raw materials1221 包装物Wrappage1231 低值易耗品Low-value consumption goods1232 材料成本差异Materials cost variance1241 自制半成品Semi-Finished goods1243 库存商品Finished goods1244 商品进销差价Differences between purchasing and selling price1251 委托加工物资Work in process - outsourced1261 委托代销商品Trust to and sell the goods on a commission basis1271 受托代销商品Commissioned and sell the goods on a commission basis 1281 存货跌价准备Inventory falling price reserves1291 分期收款发出商品Collect money and send out the goods by stages1301 待摊费用Deferred and prepaid expenses长期投资Long-term investment1401 长期股权投资Long-term investment on stocks'140101 股票投资Investment on stocks'140102 其他股权投资Other investment on stocks1402 长期债权投资Long-term investment on bonds'140201 债券投资Investment on bonds'140202 其他债权投资Other investment on bonds1421 长期投资减值准备Long-term investments depreciation reserves股权投资减值准备Stock rights investment depreciation reserves债权投资减值准备Bcreditor's rights investment depreciation reserves1431 委托贷款Entrust loans'143101 本金Principal'143102 利息Interest'143103 减值准备Depreciation reserves1501 固定资产Fixed assets房屋Building建筑物Structure机器设备Machinery equipment运输设备Transportation facilities工具器具Instruments and implement1502 累计折旧Accumulated depreciation1505 固定资产减值准备Fixed assets depreciation reserves房屋、建筑物减值准备Building/structure depreciation reserves机器设备减值准备Machinery equipment depreciation reserves1601 工程物资Project goods and material'160101 专用材料Special-purpose material'160102 专用设备Special-purpose equipment'160103 预付大型设备款Prepayments for equipment'160104 为生产准备的工具及器具Preparative instruments and implement for fabricate 1603 在建工程Construction-in-process安装工程Erection works在安装设备Erecting equipment-in-process技术改造工程Technical innovation project大修理工程General overhaul project1605 在建工程减值准备Construction-in-process depreciation reserves1701 固定资产清理Liquidation of fixed assets1801 无形资产Intangible assets专利权Patents非专利技术Non-Patents商标权Trademarks, Trade names著作权Copyrights土地使用权Tenure商誉Goodwill1805 无形资产减值准备Intangible Assets depreciation reserves专利权减值准备Patent rights depreciation reserves商标权减值准备trademark rights depreciation reserves1815 未确认融资费用Unacknowledged financial charges待处理财产损溢Wait deal assets loss or income1901 长期待摊费用Long-term deferred and prepaid expenses1911 待处理财产损溢Wait deal assets loss or income191101待处理流动资产损溢Wait deal intangible assets loss or income 191102待处理固定资产损溢Wait deal fixed assets loss or income二、负债类Liability短期负债Current liability2101 短期借款Short-term borrowing2111 应付票据Notes payable银行承兑汇票Bank acceptance商业承兑汇票Trade acceptance2121 应付账款Account payable2131 预收账款Deposit received2141 代销商品款Proxy sale goods revenue2151 应付工资Accrued wages2153 应付福利费Accrued welfarism2161 应付股利Dividends payable2171 应交税金Tax payable'217101 应交增值税value added tax payable'21710101 进项税额Withholdings on VAT'21710102 已交税金Paying tax'21710103 转出未交增值税Unpaid V AT changeover'21710104 减免税款Tax deduction'21710105 销项税额Substituted money on V AT'21710106 出口退税Tax reimbursement for export'21710107 进项税额转出Changeover withnoldings on V AT'21710108 出口抵减内销产品应纳税额Export deduct domestic sales goods tax '21710109 转出多交增值税Overpaid V AT changeover'21710110 未交增值税Unpaid V AT'217102 应交营业税Business tax payable'217103 应交消费税Consumption tax payable'217104 应交资源税Resources tax payable'217105 应交所得税Income tax payable'217106 应交土地增值税Increment tax on land value payable'217107 应交城市维护建设税Tax for maintaining and building cities payable'217108 应交房产税Housing property tax payable'217109 应交土地使用税Tenure tax payable'217110 应交车船使用税Vehicle and vessel usage license plate tax(VVULPT) payable '217111 应交个人所得税Personal income tax payable2176 其他应交款Other fund in conformity with paying2181 其他应付款Other payables2191 预提费用Drawing expense in advance其他负债Other liabilities2201 待转资产价值Pending changerover assets value2211 预计负债Anticipation liabilities长期负债Long-term Liabilities2301 长期借款Long-term loans一年内到期的长期借款Long-term loans due within one year一年后到期的长期借款Long-term loans due over one year2311 应付债券Bonds payable'231101 债券面值Face value, Par value'231102 债券溢价Premium on bonds'231103 债券折价Discount on bonds'231104 应计利息Accrued interest2321 长期应付款Long-term account payable应付融资租赁款Accrued financial lease outlay一年内到期的长期应付Long-term account payable due within one year一年后到期的长期应付Long-term account payable over one year2331 专项应付款Special payable一年内到期的专项应付Long-term special payable due within one year一年后到期的专项应付Long-term special payable over one year2341 递延税款Deferral taxes三、所有者权益类OWNERS' EQUITY资本Capital3101 实收资本(或股本) Paid-up capital(or stock)实收资本Paicl-up capital实收股本Paid-up stock3103 已归还投资Investment Returned公积3111 资本公积Capital reserve'311101 资本(或股本)溢价Cpital(or Stock) premium'311102 接受捐赠非现金资产准备Receive non-cash donate reserve'311103 股权投资准备Stock right investment reserves'311105 拨款转入Allocate sums changeover in'311106 外币资本折算差额Foreign currency capital'311107 其他资本公积Other capital reserve3121 盈余公积Surplus reserves'312101 法定盈余公积Legal surplus'312102 任意盈余公积Free surplus reserves'312103 法定公益金Legal public welfare fund'312104 储备基金Reserve fund'312105 企业发展基金Enterprise expension fund'312106 利润归还投资Profits capitalizad on return of investment利润Profits3131 本年利润Current year profits3141 利润分配Profit distribution'314101 其他转入Other chengeover in'314102 提取法定盈余公积Withdrawal legal surplus'314103 提取法定公益金Withdrawal legal public welfare funds'314104 提取储备基金Withdrawal reserve fund'314105 提取企业发展基金Withdrawal reserve for business expansion'314106 提取职工奖励及福利基金Withdrawal staff and workers' bonus and welfare fund'314107 利润归还投资Profits capitalizad on return of investment'314108 应付优先股股利Preferred Stock dividends payable'314109 提取任意盈余公积Withdrawal other common accumulation fund'314110 应付普通股股利Common Stock dividends payable'314111 转作资本(或股本)的普通股股利Common Stock dividends change to assets(or stock) '314115 未分配利润Undistributed profit四、成本类Cost4101 生产成本Cost of manufacture'410101 基本生产成本Base cost of manufacture'410102 辅助生产成本Auxiliary cost of manufacture4105 制造费用Manufacturing overhead材料费Materials管理人员工资Executive Salaries奖金Wages退职金Retirement allowance补贴Bonus外保劳务费Outsourcing fee福利费Employee benefits/welfare会议费Coferemce加班餐费Special duties市内交通费Business traveling通讯费Correspondence电话费Correspondence水电取暖费Water and Steam税费Taxes and dues租赁费Rent管理费Maintenance车辆维护费Vehicles maintenance油料费Vehicles maintenance培训费Education and training接待费Entertainment图书、印刷费Books and printing运费Transpotation保险费Insurance premium支付手续费Commission杂费Sundry charges折旧费Depreciation expense机物料消耗Article of consumption劳动保护费Labor protection fees季节性停工损失Loss on seasonality cessation 4107 劳务成本Service costs五、损益类Profit and loss收入Income业务收入OPERATING INCOME5101 主营业务收入Prime operating revenue产品销售收入Sales revenue服务收入Service revenue5102 其他业务收入Other operating revenue材料销售Sales materials代购代售包装物出租Wrappage lease出让资产使用权收入Remise right of assets revenue 返还所得税Reimbursement of income tax其他收入Other revenue5201 投资收益Investment income短期投资收益Current investment income长期投资收益Long-term investment income计提的委托贷款减值准备Withdrawal of entrust loans reserves 5203 补贴收入Subsidize revenue国家扶持补贴收入Subsidize revenue from country其他补贴收入Other subsidize revenue5301 营业外收入NON-OPERA TING INCOME非货币性交易收益Non-cash deal income现金溢余Cash overage处置固定资产净收益Net income on disposal of fixed assets出售无形资产收益Income on sales of intangible assets固定资产盘盈Fixed assets inventory profit罚款净收入Net amercement income支出Outlay业务支出Revenue charges5401 主营业务成本Operating costs产品销售成本Cost of goods sold服务成本Cost of service5402 主营业务税金及附加Tax and associate charge营业税Sales tax消费税Consumption tax城市维护建设税Tax for maintaining and building cities资源税Resources tax土地增值税Increment tax on land value5405 其他业务支出Other business expense销售其他材料成本Other cost of material sale其他劳务成本Other cost of service其他业务税金及附加费Other tax and associate charge费用Expenses5501 营业费用Operating expenses代销手续费Consignment commission charge运杂费Transpotation保险费Insurance premium展览费Exhibition fees广告费Advertising fees5502 管理费用Adminisstrative expenses职工工资Staff Salaries修理费Repair charge低值易耗摊销Article of consumption办公费Office allowance差旅费Travelling expense工会经费Labour union expenditure研究与开发费Research and development expense福利费Employee benefits/welfare职工教育经费Personnel education待业保险费Unemployment insurance劳动保险费Labour insurance医疗保险费Medical insurance会议费Coferemce聘请中介机构费Intermediary organs咨询费Consult fees诉讼费Legal cost业务招待费Business entertainment技术转让费Technology transfer fees矿产资源补偿费Mineral resources compensation fees排污费Pollution discharge fees房产税Housing property tax车船使用税Vehicle and vessel usage license plate tax(VVULPT)土地使用税Tenure tax印花税Stamp tax5503 财务费用Finance charge利息支出Interest exchange汇兑损失Foreign exchange loss各项手续费Charge for trouble各项专门借款费用Special-borrowing cost5601 营业外支出Nonbusiness expenditure捐赠支出Donation outlay减值准备金Depreciation reserves非常损失Extraordinary loss处理固定资产净损失Net loss on disposal of fixed assets出售无形资产损失Loss on sales of intangible assets固定资产盘亏Fixed assets inventory loss债务重组损失Loss on arrangement罚款支出Amercement outlay5701 所得税Income tax以前年度损益调整Prior year income adjustment现金Cash in hand银行存款Cash in bank其他货币资金-外埠存款Other monetary assets - cash in other cities其他货币资金-银行本票Other monetary assets - cashier‘s check其他货币资金-银行汇票Other monetary assets - bank draft其他货币资金-信用卡Other monetary assets - credit cards其他货币资金-信用证保证金Other monetary assets - L/C deposit其他货币资金-存出投资款Other monetary assets - cash for investment短期投资-股票投资Investments - Short term - stocks短期投资-债券投资Investments - Short term - bonds短期投资-基金投资Investments - Short term - funds短期投资-其他投资Investments - Short term - others短期投资跌价准备Provision for short-term investment长期股权投资-股票投资Long term equity investment - stocks长期股权投资-其他股权投资Long term equity investment - others长期债券投资-债券投资Long term securities investemnt - bonds长期债券投资-其他债权投资Long term securities investment - others长期投资减值准备Provision for long-term investment应收票据Notes receivable应收股利Dividends receivable应收利息Interest receivable应收帐款Trade debtors坏帐准备- 应收帐款Provision for doubtful debts - trade debtors预付帐款Prepayment应收补贴款Allowance receivable其他应收款Other debtors坏帐准备- 其他应收款Provision for doubtful debts - other debtors其他流动资产Other current assets物资采购Purchase原材料Raw materials包装物Packing materials低值易耗品Low value consumbles材料成本差异Material cost difference自制半成品Self-manufactured goods库存商品Finished goods商品进销差价Difference between purchase & sales of commodities委托加工物资Consigned processiong material委托代销商品Consignment-out受托代销商品Consignment-in分期收款发出商品Goods on instalment sales存货跌价准备Provision for obsolete stocks待摊费用Prepaid expenses待处理流动资产损益Unsettled G/L on current assets待处理固定资产损益Unsettled G/L on fixed assets委托贷款-本金Consignment loan - principle委托贷款-利息Consignment loan - interest委托贷款-减值准备Consignment loan - provision固定资产-房屋建筑物Fixed assets - Buildings固定资产-机器设备Fixed assets - Plant and machinery固定资产-电子设备、器具及家具Fixed assets - Electronic Equipment, furniture and fixtures 固定资产-运输设备Fixed assets - Automobiles累计折旧Accumulated depreciation固定资产减值准备Impairment of fixed assets工程物资-专用材料Project material - specific materials工程物资-专用设备Project material - specific equipment工程物资-预付大型设备款Project material - prepaid for equipment工程物资-为生产准备的工具及器具Project material - tools and facilities for production 在建工程Construction in progress在建工程减值准备Impairment of construction in progress固定资产清理Disposal of fixed assets无形资产-专利权Intangible assets - patent无形资产-非专利技术Intangible assets - industrial property and know-how无形资产-商标权Intangible assets - trademark rights无形资产-土地使用权Intangible assets - land use rights无形资产-商誉Intangible assets - goodwill无形资产减值准备Impairment of intangible assets长期待摊费用Deferred assets未确认融资费用Unrecognized finance fees其他长期资产Other long term assets递延税款借项Deferred assets debits应付票据Notes payable应付帐款Trade creditors预收帐款Adanvances from customers代销商品款Consignment-in payables其他应交款Other payable to government其他应付款Other creditors应付股利Proposed dividends待转资产价值Donated assets预计负债Accrued liabilities应付短期债券Short-term debentures payable其他流动负债Other current liabilities预提费用Accrued expenses应付工资Payroll payable应付福利费Welfare payable短期借款-抵押借款Bank loans - Short term - pledged短期借款-信用借款Bank loans - Short term - credit短期借款-担保借款Bank loans - Short term - guaranteed一年内到期长期借款Long term loans due within one year一年内到期长期应付款Long term payable due within one year长期借款Bank loans - Long term应付债券-债券面值Bond payable - Par value应付债券-债券溢价Bond payable - Excess应付债券-债券折价Bond payable - Discount应付债券-应计利息Bond payable - Accrued interest长期应付款Long term payable专项应付款Specific payable其他长期负债Other long term liabilities应交税金-所得税Tax payable - income tax应交税金-增值税Tax payable - V AT应交税金-营业税Tax payable - business tax应交税金-消费税Tax payable - consumable tax应交税金-其他Tax payable - others递延税款贷项Deferred taxation credit股本Share capital已归还投资Investment returned利润分配-其他转入Profit appropriation - other transfer in利润分配-提取法定盈余公积Profit appropriation - statutory surplus reserve利润分配-提取法定公益金Profit appropriation - statutory welfare reserve利润分配-提取储备基金Profit appropriation - reserve fund利润分配-提取企业发展基金Profit appropriation - enterprise development fund利润分配-提取职工奖励及福利基金Profit appropriation - staff bonus and welfare fund利润分配-利润归还投资Profit appropriation - return investment by profit利润分配-应付优先股股利Profit appropriation - preference shares dividends利润分配-提取任意盈余公积Profit appropriation - other surplus reserve利润分配-应付普通股股利Profit appropriation - ordinary shares dividends利润分配-转作股本的普通股股利Profit appropriation - ordinary shares dividends converted to shares期初未分配利润Retained earnings, beginning of the year资本公积-股本溢价Capital surplus - share premium资本公积-接受捐赠非现金资产准备Capital surplus - donation reserve资本公积-接受现金捐赠Capital surplus - cash donation资本公积-股权投资准备Capital surplus - investment reserve资本公积-拨款转入Capital surplus - subsidiary资本公积-外币资本折算差额Capital surplus - foreign currency translation资本公积-其他Capital surplus - others盈余公积-法定盈余公积金Surplus reserve - statutory surplus reserve盈余公积-任意盈余公积金Surplus reserve - other surplus reserve盈余公积-法定公益金Surplus reserve - statutory welfare reserve盈余公积-储备基金Surplus reserve - reserve fund盈余公积-企业发展基金Surplus reserve - enterprise development fund盈余公积-利润归还投资Surplus reserve - return investment by investment主营业务收入Sales主营业务成本Cost of sales主营业务税金及附加Sales tax营业费用Operating expenses管理费用General and administrative expenses财务费用Financial expenses投资收益Investment income其他业务收入Other operating income营业外收入Non-operating income补贴收入Subsidy income其他业务支出Other operating expenses 营业外支出Non-operating expenses所得税Income tax。

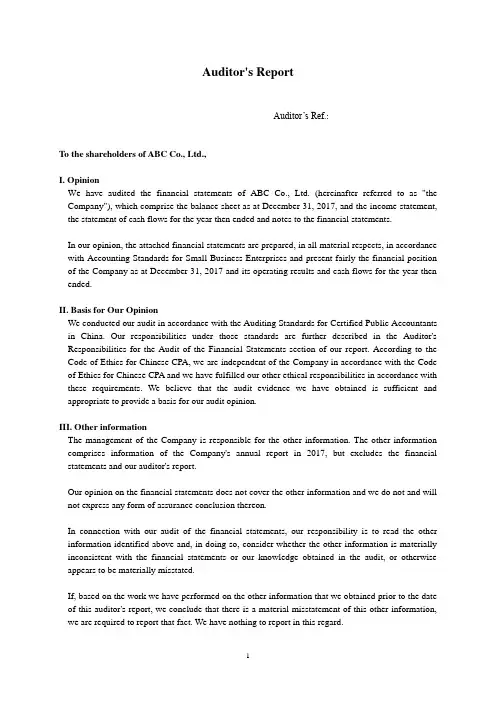

Auditor's ReportAuditor’s Ref.:To the shareholders of ABC Co., Ltd.,I. OpinionWe have audited the financial statements of ABC Co., Ltd. (hereinafter referred to as "the Company"), which comprise the balance sheet as at December 31, 2017, and the income statement, the statement of cash flows for the year then ended and notes to the financial statements.In our opinion, the attached financial statements are prepared, in all material respects, in accordance with Accounting Standards for Small Business Enterprises and present fairly the financial position of the Company as at December 31, 2017 and its operating results and cash flows for the year then ended.II. Basis for Our OpinionWe conducted our audit in accordance with the Auditing Standards for Certified Public Accountants in China. Our responsibilities under those standards are further described in the Auditor's Responsibilities for the Audit of the Financial Statements section of our report. According to the Code of Ethics for Chinese CPA, we are independent of the Company in accordance with the Code of Ethics for Chinese CPA and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.III. Other informationThe management of the Company is responsible for the other information. The other information comprises information of the Company's annual report in 2017, but excludes the financial statements and our auditor's report.Our opinion on the financial statements does not cover the other information and we do not and will not express any form of assurance conclusion thereon.In connection with our audit of the financial statements, our responsibility is to read the other information identified above and, in doing so, consider whether the other information is materially inconsistent with the financial statements or our knowledge obtained in the audit, or otherwise appears to be materially misstated.If, based on the work we have performed on the other information that we obtained prior to the date of this auditor's report, we conclude that there is a material misstatement of this other information, we are required to report that fact. We have nothing to report in this regard.IV. Responsibilities of Management and Those Charged with Governance for the Financial StatementsThe Company's management is responsible for preparing the financial statements in accordance with the requirements of Accounting Standards for Small Business Enterprises to achieve a fair presentation, and for designing, implementing and maintaining internal control that is necessary to ensure that the financial statements are free from material misstatements, whether due to frauds or errors.In preparing the financial statements, management of the Company is responsible for assessing the Company's ability to continue as a going concern, disclosing matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Company or to cease operations, or has no realistic alternative but to do so.Those charged with governance are responsible for overseeing the Company's financial reporting process.V. Auditor's Responsibilities for the Audit of the Financial StatementsOur objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor's report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with the audit standards will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.As part of an audit in accordance with the audit standards, we exercise professional judgment and maintain professional scepticism throughout the audit. We also:(1) Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, omissions, misrepresentations, or the override of internal control.(2) Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances,but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control(3) Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management of the Company.(4) Conclude on the appropriateness of using the going concern assumption by the management of the Company, and conclude, based on the audit evidence obtained, whether a material uncertaintyexists related to events or conditions that may cast significant doubt on the Company's ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor's report to the related disclosures in the financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor's report. However, future events or conditions may cause the Company to cease to continue as a going concern.(5) Evaluate the overall presentation, structure and content of the financial statements, including the disclosures, and whether the financial statements represent the underlying transactions and events in a manner that achieves fair presentation.We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit matters, including any significant deficiencies in internal control that we identify during our audit.Certified Public Accountant of China:Certified Public Accountant of China:XYZ Certified Public Accountants Co., Ltd.Guangdong, ChinaMarch 23, 2018附:审计报告2018中文标准版(小企业会计准则)审计报告审计报告文号: ABC有限公司股东:一、审计意见我们审计了后附的ABC有限公司(以下简称贵公司)财务报表,包括2017年12月31日的资产负债表、2017年度的利润表和现金流量表以及财务报表附注。

是什么SBU?SBU的含义及要素 SBU是Strategical Business Unite 的缩写,即战略事业单位,⼜称战略业务单元所谓战略事业单元(Strategic Business Unit,简称SBU),既可以指⼀家完全独⽴的中型企业,也可以是⼀家⼤公司或集团内的⼀个事业部门,只要这个部门能够独⽴规划⾃⼰的经营战略、有独⽴的经营⽬标,就可以被视为⼀个战略事业单元。

“全员SBU理念”的意思是:如果不仅每个事业部⽽且每个⼈都是SBU,那么集团总的战略就会落实到每⼀个员⼯,⽽每⼀个员⼯的战略创新⼜会保证集团战略的实现。

每个⼈都去创新,都以速度去争取⽤户,那么他就应该成为⼀个SBU。

这样,每个员⼯都必须⾯对市场、时刻想到如何满⾜消费者的需求。

这使海尔从⼀个3万⼈的企业变成3万个⼩企业,3万个⼩企业⼜可以瞬间组合成⼀个有竞争⼒的品牌。

SBU的⽬标对员⼯意味着要成为创新的主体,在为⽤户创造价值中,体现⾃⾝的价值,实际上就是经营⾃我。

海尔要求每个⼈要好好把握⾃⼰,经营⾃⼰,成为创新的、⾃主经营的SBU,形成企业的核⼼竞争⼒,这才是任何竞争对⼿不能模仿和复制的。

“SBU”必须由四个因素构成:第⼀,明确的⽬标;第⼆,企业提供的平台与资源;第三,⼯作流程;第四,分配关系,即每个⼈的收⼊与其成果挂钩,⽽每个⼈的成果⼜服务于企业的成果。

SBU是⼀种绩效考核⽅式。

事业部是独⽴单位,最贴切的⽐喻是:个体户。

SBU 就是:每个⼈都当(以)虚拟的个体户⽅式⼯作;或者,说开放初期的“个⼈承包”经营。

可在中国的国有企业,实施SBU太难了。

1、发“包”很难合理。

2、权限、利益、等级与⾯⼦很难放给个⼈。

就是亲兄弟合办的公司,SBU很难推⾏,虽然开始就是SBU。

⽬标管理的具体做法分三个阶段:第⼀阶段为⽬标的设置;第⼆阶段为实现⽬标过程的管理;第三阶段为测定与评价所取得的成果。

SBU是英⽂Strategic Business Unit的缩写,中⽂直译为战略业务单位,亦可译为事业部。

企业管理英语作文Enterprise Management。

Enterprise management is an important aspect of running a business. It involves organizing and overseeing all aspects of a company's operations, including finance, marketing, production, and human resources. Effective enterprise management is crucial for the success of any business, regardless of its size or industry.One of the key elements of enterprise management is strategic planning. This involves setting goals and objectives for the company, and developing a plan to achieve them. Strategic planning takes into account the company's strengths and weaknesses, as well asopportunities and threats in the external environment.Another important aspect of enterprise management is financial management. This involves managing the company's finances, including budgeting, accounting, and financialreporting. Financial management is essential for ensuring that the company is profitable and sustainable over the long term.Marketing is also a crucial component of enterprise management. This involves promoting the company's products or services to potential customers, and developing strategies to attract and retain customers. Effective marketing is essential for building brand awareness and driving sales.Production management is another important aspect of enterprise management. This involves managing the production process, including procurement, manufacturing, and distribution. Effective production management is essential for ensuring that the company's products are of high quality, and that they are delivered to customers on time and at a reasonable cost.Finally, human resource management is crucial for enterprise management. This involves managing the company's workforce, including recruitment, training, and performancemanagement. Effective human resource management isessential for ensuring that the company has the rightpeople in the right roles, and that they are motivated and engaged in their work.In conclusion, enterprise management is a complex and multifaceted discipline that requires a range of skills and knowledge. Effective enterprise management is essential for the success of any business, and requires careful planning, financial management, marketing, production management, and human resource management. By implementing these strategies, companies can improve their competitiveness, profitability, and sustainability over the long term.。

{财务管理财务知识}财务管理英语中英文对照ACCA--财务管理英语solepropsietorship独资企业partnership合伙企业corporatefinance公司财务corporate公司closelyheld私下公司publicpany公众公司GoldmanSachs高盛银行pensionfund养老基金insurancepany保险公司boardofdirector董事会separationofownershipandmanagement所有权与管理权的分离limitedliability有限责任articlesofincorporation公司章程realasset实物资产financialasset金融资产security证券financialmarket金融市场capitalmarket资本市场moneymarket货币市场investmentdecision投资决策capitalbudgetingdecision资本预算决策financingdecision融资决策financialmanager财务经理treasurer司库controller总会计师CFO首席财务官principal-agentproblem委托代理问题principal委托人agent代理人agencycost代理成本informationasymmetry信息不对称signal信号efficientmarketshypothesis有效市场假说presentvalue现值discountfactor贴现因子rateofreturn收益率discountrate贴现率hurdlerate门坎比率opportunitycostofcapital资本机会成本netpresentvalue净现值cashoutflow现金支出netpresentvaluerule净现值法则rate-of-returnrule收益率法则profitmaximization利润最大化doingwell经营盈利doinggood经营造益collateral抵押品warrant认股权证convertiblebond可转换债券primaryissue一级发行prinarymarket一级市场secondarytansaction二级交易secondarymarket二级市场over-the-counter(OTC)场外交易financialintermediary金融中介zero-stage启动阶段businessplan创业计划书first-stagefinancing第一阶段融资after-the-moneyvaluation注资后的价值papergain账面利润mezzaninefinancing引渡融资angelinvestor天使投资者venturecapitalfund创业投资基金limitedprivatepartnership有限合伙企业generalpartner普通合伙人limitedpartner有限合伙人small-businessinvestmentpanies(SBIC)小企业投资公司initialpublicoffering(IPO)首次公开发行primaryoffering首次发行secondaryoffering二次发行underwriter承销商syndicateofunderwriter承销辛迪加registrationstatement注册说明书prospectus招股说明书roadshow路演greenshoeoption绿鞋期权spread差价offeringprice发售价格underpricing抑价winner’scurse成功者灾难bookbuilding标书登记fixedpriceoffer定价发售auction拍卖discriminationauction差价拍卖uniform-priceauction一价拍卖generalcashoffer一般现款发行rightissue附权发行shelfregistration上架注册priorapproval事前许可boughtdeal买方交易seasonedissue新增发行knowledgeableinvertor成熟的投资者qualifiedinstitutionalbuyer有资格的机构买者recorddate登记日withdividend附有红利cumdividend附息exdividend除息legalcapital法定资本regularcashdividend正常现金红利extra额外的specialdividend特别红利stockdividend股票红利automaticdividendreinvestmentplans(DRIP)红利自动转投计划transferofvalue价值转移capitalstructure资本结构MM’spropositionMM定理weighted-averagecostofcapital(WACC)加权平均资本成本margindebt保证金借款floating-ratenote浮动利率票据money-marketfund货币市场基金interest-rateceiling利率上限trade-offtheory权衡理论righttodefault违约权leveragebuy-out(LBO)杠杆收购asymmetricinformation信息不对称financialslack银根宽松costofdebt负债成本costofequity权益成本terminalvalue清算价值cashflowtoequity权益现金流rebalancing重整projectfinancing项目融资adjustedcostofcapital调整资本成本equivalentloan等值贷款offsettingtransaction反向交易depreciablebasis折旧基数adjustedpresentvalue(APV)调整现值calloption看涨期权exerciseprice执行价格strikeprice敲定价格exercisedate到期日Europeancall欧式看涨期权Americancall美式看涨期权positiondiagram头寸图putoption看跌期权SalomonBrothers所罗门兄弟公司termstuctureofinterestrate利率期限结构annuity年金perpetuity永久年金annuityfactor年金因子annuitydue即期年金futurevalue终值conmpoundinterest复利simpleinterest单利continuouslypoundedrate连续复利率ConsumerPriceIndex(CPI)消费物价指数currentdollar当期货币nominaldollar名义货币constantdollar不变货币realdollar实际货币realrateofreturn实际收益率inflationrate通货膨胀率principal本金deflation滞胀yieldtomaturity到期收益率marketcapitalizationrate市场资本化率dividendyield红利收益率costofequitycapital权益资本成本payoutratio红利发放率earningspershare(EPS)每股收益returnonequity(ROE)权益收益率discountcashflow贴现现金流growthstock成长股inestock绩优股presentvalueofgrowthopportunity(PVGO)成长机会的现值price-earningsratio(P/E)市盈率freecashflow(FCF)自由现金流量bookrateofreturn账面收益率capitalinvestment资本投资operatingexpense经营费用paybackperiod回收期discounted-paybackrule贴现回收期法则discounted-cash-flowrateofreturn贴现现金流量的收益率internalrateofreturn(IRR)内部收益率lending贷出borrowing借入profitabilitymeasure盈利指标standardofpfofitability赢利标准modifiedinternalrateofreturn修正内部收益率mutuallyexclusiveprojects互相排斥的项目capitalrationing资本约束profitabilityindex盈利指标softrationing软约束hardrationing硬约束incrementalpayoff增量收入networkingcapital净营运资本sunkcost沉没成本sunk-costfallacy沉没成本悖论overheadcost间接费用salvagevalue残值straight-linedepreciation直线法折旧InternalRevenueService国内税收署taxshield税盾acceleratedcostrecoverysystem加速成本回收折旧法alternativeminimumtax另类最低税taxpreference税收优惠accelerateddepreciation加速折旧projectanalysis项目分析equivalentannualcashflow等价年度现金流marginalinvestment边际投资defaultrisk违约风险riskpremium风险溢酬standarderror标准误差standarddeviation标准差marketportfolio市场组合marketreturm(rm)市场收益率variance方差thelossofadgreeoffreedom自由度损失Delphic德尔菲uniquerisk独特风险unsystematicrisk非系统风险residualrisk剩余风险specificrisk特定风险diversifiablerisk可分散风险marketrisk市场风险systematicrisk系统风险undiversifiablerisk不可分散风险convariance协方差well-diversified有效分散valueadditivity价值可加性efficientportfolio有效投资组合quadraticprogramming二次规划bestefficientportfolio最佳有效投资组合capitalassetpricingmodel(CAPM)资本资产定价模型separationtheorem分离定理securitymarketline证券市场线marketcapitalization市场资本总额small-capstocks小盘股book-to-marketration账面-市值比datamining数据挖掘datasnooping数据侦察consumptionbeta消费贝塔consumptionCAPM消费型资本资产定价模型riskaversion风险厌恶arbitragepricingtheory套利定价理论sensitivityofeachstocktothesefactors每种股票对这些因素的敏感度three-factormodel三因素模型panycostofcapital公司资本成本industrybeta行业贝塔firmvalue公司价值debtvalue负债价值assetvalue资产价值blue-chipfirm蓝筹股financialleverage财务杠杆gearing举债经营financialrisk财务风险unlever消除杠杆relativemarketvaluesofdebt(E/V)负债的相对市场价值taxableine应税利润after-taxcost税后成本marginalcorporatetaxrate公司边际税率after-taxweighted-averagecostofcapital税后加权平均资本成本cyclicality周期性cyclicalfirms周期性公司operatingleverage经营杠杆revenue收入fixedcosts固定成本variablecosts可变成本rateofoutput产出率certaintyequivalent确定性等价值certainty-equivalentcashflow确定性等价现金流risk-adjusteddiscountrate风险相应贴现率underlyingvariables基础变量sample抽样realoption实物期权decisiontree决策树timingqption安排期权productionoption生产性期权optiontobailout清算选择权economicrent经济租金futuremarket期货市场capitalbudget资本预算strategicplanning战略规划appropriationrequest拨款申请postaudit事后审计stockoptions股票期权privatebenefit私下利益perks特权享受perquisite特权享受overinvestment过度投资generallyacceptedaccountingprinciple(GAAP)公认会计原则qualifieddoption保留意见delegated委托economicvalueadded(EVA)经济附加值tradeloading贸易超载economicdepreciation经济折旧nationalineandproductaccounts国民收入与产出账户cap上限合约strip本息剥离债券swap互换bookrunner股份登记员efficientcapitalmarket有效资本市场randomwalk随机游走positivedrift正漂移autocorelationcoefficient自相关系数weakformofefficiency弱有效性semistrongformofefficiency半强有效性strongformofefficiency强有效性marketmodel市场模型acquiringfirm兼并公司acquiredfirm被兼并公司superiorprofit超常利润overreaction反应过度underreaction反应不足indexarbitrageur指数套利者portfolioinsurancescheme证券组合保险策略superiorratesofreturn超常收益exchange-ratepolicy汇率政策applicationdate申购日long-termasset长期资产retainedearnings留存收益financialdeficit资金缺口internalfund内部资金debtpolicy负债政策dividendpolicy红利政策long-termfinancing长期融资totalcapitalization资本总额reserve准备金issuedandoutsanding已发行流通股份issuedbutnotoutsanding已发行未流通股份authorizedsharecapital法定股本总额financialinstitution金融机构cash-flowright现金流要求权controlright控制劝dominantstockholder控股股东majorityvotingsystem多数投票制cumulativevoting累计投票制supermajority绝对多数制proxycontest投票代理权角逐minoritystockholder小股东reversestocksplit逆股票拆细masterlimitedpartnership业主有限责任合伙企业realestateinvestmenttrust(REIT)房地产信托投资基金preferredstock优先股cumulativepreferredstock红利累积优先股lineofcredit授信额度fixed-rate固定利率floating-rate浮动利率coupon息票LondonInterbankOfferedRate(LIBOR)伦敦银行间拆借利率eurobond欧洲债券eurocurrency欧洲货币euro欧元senior优级junior次级subordinated从属secured有担保的collateral抵押品warrant认股权证convertiblebond可转换债券primaryissue一级发行prinarymarket一级市场secondarytansaction二级交易secondarymarket二级市场over-the-counter(OTC)场外交易financialintermediary金融中介zero-stage启动阶段businessplan创业计划书first-stagefinancing第一阶段融资after-the-moneyvaluation注资后的价值papergain账面利润mezzaninefinancing引渡融资angelinvestor天使投资者venturecapitalfund创业投资基金limitedprivatepartnership有限合伙企业generalpartner普通合伙人limitedpartner有限合伙人small-businessinvestmentpanies(SBIC)小企业投资公司initialpublicoffering(IPO)首次公开发行primaryoffering首次发行secondaryoffering二次发行underwriter承销商syndicateofunderwriter承销辛迪加registrationstatement注册说明书prospectus招股说明书roadshow路演greenshoeoption绿鞋期权spread差价offeringprice发售价格underpricing抑价winner’scurse成功者灾难bookbuilding标书登记fixedpriceoffer定价发售auction拍卖discriminationauction差价拍卖uniform-priceauction一价拍卖generalcashoffer一般现款发行rightissue附权发行shelfregistration上架注册priorapproval事前许可boughtdeal买方交易seasonedissue新增发行knowledgeableinvertor成熟的投资者qualifiedinstitutionalbuyer有资格的机构买者recorddate登记日withdividend附有红利cumdividend附息exdividend除息legalcapital法定资本regularcashdividend正常现金红利extra额外的specialdividend特别红利stockdividend股票红利automaticdividendreinvestmentplans(DRIP)红利自动转投计划transferofvalue价值转移capitalstructure资本结构MM’spropositionMM定理weighted-averagecostofcapital(WACC)加权平均资本成本margindebt保证金借款floating-ratenote浮动利率票据money-marketfund货币市场基金interest-rateceiling利率上限trade-offtheory权衡理论righttodefault违约权leveragebuy-out(LBO)杠杆收购asymmetricinformation信息不对称financialslack银根宽松costofdebt负债成本costofequity权益成本terminalvalue清算价值cashflowtoequity权益现金流rebalancing重整projectfinancing项目融资adjustedcostofcapital调整资本成本equivalentloan等值贷款offsettingtransaction反向交易depreciablebasis折旧基数adjustedpresentvalue(APV)调整现值calloption看涨期权exerciseprice执行价格strikeprice敲定价格exercisedate到期日Europeancall欧式看涨期权Americancall美式看涨期权positiondiagram头寸图putoption看跌期权感谢阅读多年企业管理咨询经验,专注为企业和个人提供精品管理方案,企业诊断方案,制度参考模板等欢迎您下载,均可自由编辑。

有关管理企业的英文作文英文:Managing a business is a multifaceted endeavor that requires a delicate balance of various skills and strategies. From my experience, I've found that effective management encompasses not only overseeing daily operations but also fostering a positive work environment and driving long-term growth.One crucial aspect of managing a business is communication. Clear and open communication channels are essential for ensuring that everyone in the organization is on the same page. For example, during a recent project launch, miscommunication between departments led to delays and confusion. To address this issue, I implemented regular team meetings where all stakeholders could provide updates and raise concerns. This simple change significantly improved coordination and productivity.Another key skill in business management is adaptability. Markets are constantly evolving, and a successful business must be able to pivot and adjust its strategies accordingly. I recall a situation where our primary supplier unexpectedly increased prices, threatening our profit margins. Instead of panicking, I researched alternative suppliers and negotiated better deals. This flexibility allowed us to maintain our competitive edge despite the initial setback.Furthermore, effective delegation is essential for sustainable growth. As a manager, I've learned that trying to do everything myself is not only impractical but also detrimental to the team's morale. Delegating tasks empowers employees and frees up time for strategic planning and innovation. For instance, when launching a new marketing campaign, I delegated specific tasks to each member of the marketing team based on their strengths and expertise. This approach not only improved efficiency but also encouraged creativity and collaboration.Moreover, a successful manager must lead by example.Employees look to their leaders for guidance andinspiration, so it's crucial to demonstrate integrity, professionalism, and a strong work ethic. For example, during a challenging period of restructuring, I made sureto remain transparent about the company's goals and challenges while maintaining a positive attitude. This helped boost morale and fostered a sense of unity among the team.In conclusion, managing a business requires a combination of effective communication, adaptability, delegation, and leadership. By mastering these skills and continuously learning and adapting to new challenges, I believe any manager can steer their company towards success.中文:管理企业是一项多方面的任务,需要平衡各种技能和策略。

Windows Server 2003 R2已经距离发布已有两年多时间,正因为2003非常经典,至今仍是很多网友的挚爱,本文特别整理Server 2003中英文MSDN官方版本,以便各位下载收藏(微软补丁支持到2015年),Windows Server 2003 R2是Windows Server 2003系列的最新版本,在分公司服务器管理、跨组织的身份认证、以及网络储存管理等三个领域进行了强化。

Windows 2003 标准版、企业版的区别1、Windows Server 2003标准版是满足所有规模的公司(特别是小企业和工作组)日常需要的理想的多用途网络操作系统。

1、Windows Server 2003企业版在Windows Server 2003标准版功能的基础上生成,添加业务关键的应用程序所需的可靠性功能。

一、Windows Server 2003 R2(X86)中英文版本1、英文标准版SP2 (x86)文件名 en_win_srv_2003_r2_standard_with_sp2_vl_cd1x13-46600.iso 邮寄日期 (UTC): 4/27/2007 11:06:15 PMSHA1: 96CDE4E7170164BCEFB87131892337461DBDA9B7 ISO/CRC: N/A文件名 en_win_srv_2003_r2_standard_with_sp2_vl_cd2_x13-68583.iso 邮寄日期 (UTC): 4/27/2007 11:06:15 PMSHA1: 676B184C13A344DE0B28F6841AD01D8F13696F93 ISO/CRC: 59181242种子下载(包含两张盘):网盘下载种子2、英文企业版SP2 (x86)文件名 en_win_srv_2003_r2_enterprise_with_sp2_vl_cd1_x13-48610.iso 邮寄日期 (UTC): 4/27/2007 11:06:15 PMSHA1: 0D0CDDD29FCF8FF7456A4BE8CE15698EBA90D1DC ISO/CRC: N/A文件名 en_win_srv_2003_r2_enterprise_with_sp2_vl_cd2_x13-68584.iso 邮寄日期 (UTC): 4/27/2007 11:06:15 PMSHA1: A0BE7279E8692DD2EA718BDF54844E4A17ACFEF1 ISO/CRC: CDF77EDB种子下载(包含两张盘):网盘下载种子3、简体中文标准版SP2 (x86)文件名 cn_win_srv_2003_r2_standard_with_sp2_vl_cd1_x13-46532.iso 邮寄日期 (UTC): 4/27/2007 11:06:15 PMSHA1: 30A43BE69B14767548C311F96AF8649FE77C0F5E ISO/CRC: N/A文件名 cn_win_srv_2003_r2_standard_with_sp2_vl_cd2_x13-13942.iso 邮寄日期 (UTC): 4/27/2007 11:06:15 PMSHA1: 00A4207565F82E584916F2CBB61E7CFF00B95C8B ISO/CRC: F4682483种子下载(包含两张盘):网盘下载种子4、简体中文企业版SP2 (x86)文件名 cn_win_srv_2003_r2_enterprise_with_sp2_vl_cd1_x13-46432.iso 邮寄日期 (UTC): 4/27/2007 11:06:15 PMSHA1: D0DD2782E9387328EBFA45D8804B6850ACABF520 ISO/CRC: N/A文件名 cn_win_srv_2003_r2_enterprise_with_sp2_vl_cd2_x13-13895.iso 邮寄日期 (UTC): 4/27/2007 11:06:15 PMSHA1: 4B364E848FCC59762DDDCED1493248E2896EE033 ISO/CRC: A9488E36种子下载(包含两张盘):网盘下载种子二、Windows Server 2003 R2(X64)中英文版本1、英文标准版SP2 (x64)文件名 en_win_srv_2003_r2_standard_x64_with_sp2_vl_cd1_x13-47808.iso 邮寄日期 (UTC): 4/27/2007 11:06:15 PMSHA1: 0EB35C93F2A0F02081E8B77E981D9EB90B59DB54 ISO/CRC: N/A文件名 en_win_srv_2003_r2_standard_x64_with_sp2_vl_cd2_x13-68587.iso 邮寄日期 (UTC): 4/27/2007 11:06:15 PMSHA1: C9DA0658A9A777EB464F4F23DA25BF25916DEE47 ISO/CRC: E36B88D7种子下载(包含两张盘):网盘下载种子2、英文企业版SP2 (x64)文件名en_win_srv_2003_r2_enterprise_x64_with_sp2_vl_cd1_x13-48614.iso 邮寄日期 (UTC): 4/27/2007 11:06:15 PMSHA1: A747E66B5206A8A5A4904B93A273FA0DF8130CA1 ISO/CRC: N/A文件名en_win_srv_2003_r2_enterprise_x64_with_sp2_vl_cd2_x13-68588.iso 邮寄日期 (UTC): 4/27/2007 11:06:15 PMSHA1: 54B845F1E4C27C9C96AACEF59B9AB19CEFE1C8BC ISO/CRC: BADD5028种子下载(包含两张盘):网盘下载种子3、简体中文标准版SP2 (x64)文件名 cn_win_srv_2003_r2_standard_x64_with_sp2_vl_cd1_x13-47363.iso 邮寄日期 (UTC): 4/27/2007 11:06:15 PMSHA1: 5A27D75F82E2495663F3257857BA4FA39307331C ISO/CRC: N/A文件名 cn_win_srv_2003_r2_standard_x64_with_sp2_vl_cd2_x13-28819.iso 邮寄日期 (UTC): 4/27/2007 11:06:15 PMSHA1: BC1449BCB357DF9A699AD929F6FD2ACB6629A186 ISO/CRC: 90EF5E6F种子下载(包含两张盘):网盘下载种子4、简体中文企业版SP2 (x64)文件名cn_win_srv_2003_r2_enterprise_x64_with_sp2_vl_cd1_x13-47314.iso 邮寄日期 (UTC): 4/27/2007 11:06:15 PMSHA1: FDA1A0401CA610F6E3A7780D6DB004DA2F944138 ISO/CRC: N/A文件名cn_win_srv_2003_r2_enterprise_x64_with_sp2_vl_cd2_x13-35321.iso 邮寄日期 (UTC): 4/27/2007 11:06:15 PMSHA1: 42CB2508F37B7B3331B8EB7A04D58DB508248821 ISO/CRC: 42B94FC6种子下载(包含两张盘):网盘下载种子部分参考序列号(来源于网络,未验证,如可能请支持正版事业!):Windows Server 2003 VLK标准版——M6RJ9-TBJH3-9DDXM-4VX9Q-K8M8M——JCGMJ-TC669-KCBG7-HB8X2-FXG7M——QW32K-48T2T-3D2PJ-DXBWY-C6WRJWindows Server 2003 VLK企业版——BRKX3-BB88X-GP7VW-HYQJR-C7QHM——HYDGJ-3WY89-YJB68-H2DV2-BYT7M——BPQBT-4MTVT-CDQGB-BGVFP-MK8YB。